The Financial Times reported last week that Saudi Arabia is directly seeking to regain market share and is, therefore, ready to accept lower prices for a period. Initially, they are prepared to bring more oil to the market starting on December 1 and implement OPEC+'s plan to increase oil production through 2025 gradually. It could be the first indication that OPEC+ - or rather Saudi Arabia - is shifting towards a "volume strategy" at the expense of the current "price strategy."

Of course, the FT story may not hold water, or Saudi Arabia may be attempting to send a strong signal to quota cheaters such as Iraq, Kazakhstan, and Russia, warning that they are ready to let oil prices fall if overproduction does not cease.

Last week, Russia's oil minister, among others, tried to convince the market that no new decision had been made regarding increased oil production. However, other anonymous sources suggested that there is room for greater production if the quota cheaters reduce their output according to the so-called compensation cuts.

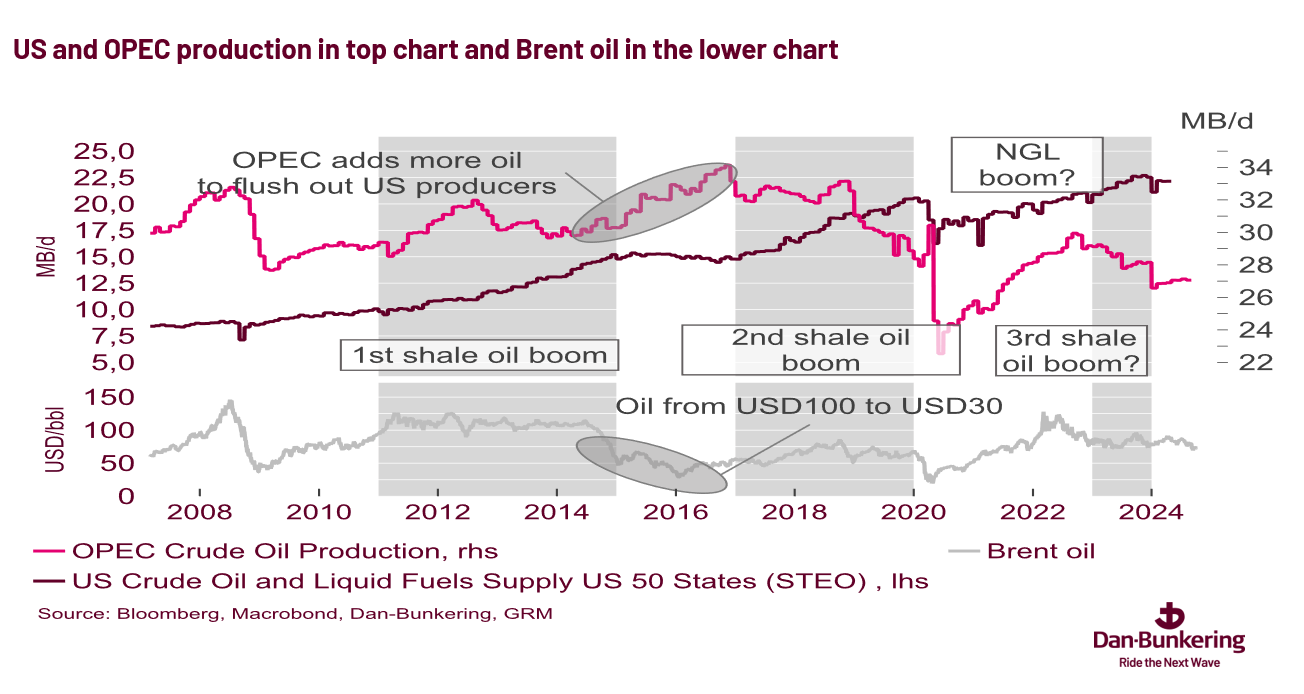

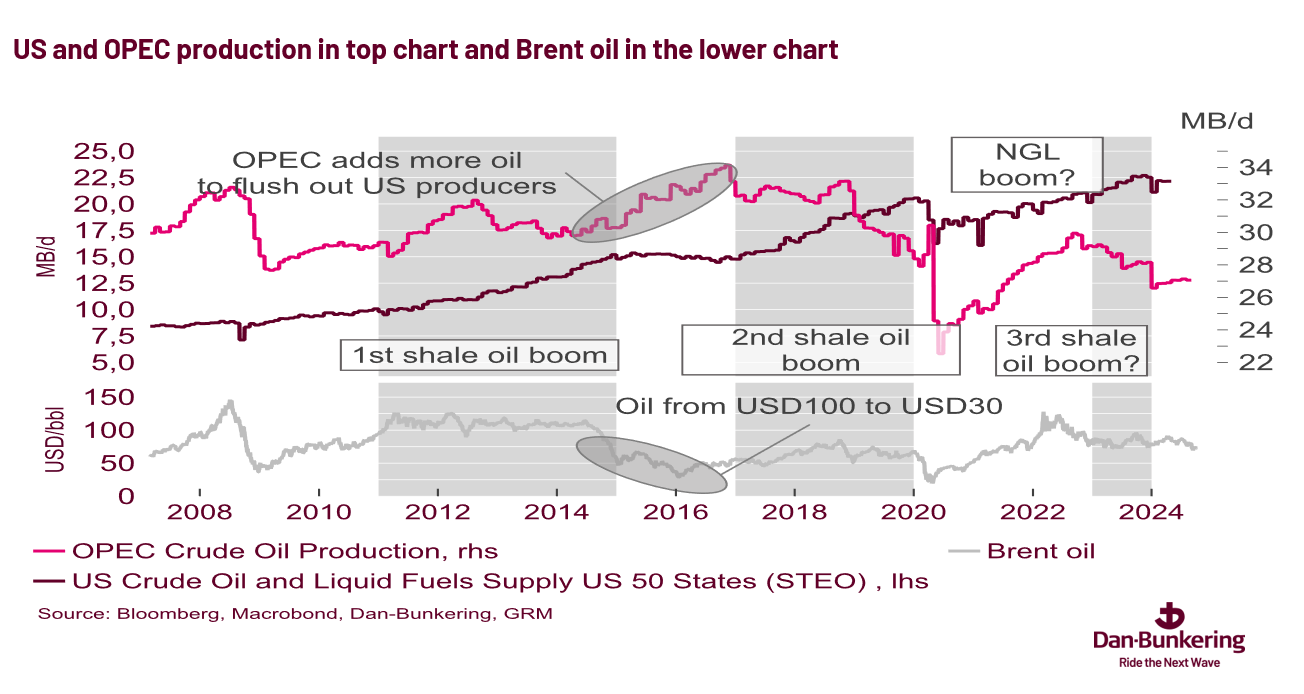

The main concern - or what some might call the "elephant in the room" - for the market is that this situation is beginning to resemble 2014-2015, when OPEC significantly increased production to regain market share from the booming US shale oil producers. However, it may not be as easy this time. US producers are much stronger financially and can withstand a lower oil price. In 2014-2015, the oil price fell from over USD 100 to briefly below USD 30.

Importantly, we do not believe that OPEC+ - or rather Saudi Arabia - is about to enter a trade war like in 2014-15. However, the article and the weak media response from OPEC+ representatives, including Russia and anonymous OPEC delegates last week, have increased short-term downside risks.

OPEC+ will hold its next Joint Ministerial Monitoring Committee (JMMC) meeting on October 2, where discussions about adding more oil will continue, and the quota cheaters will likely face scrutiny. Do not expect a firm conclusion on whether more oil will be added on December 1.

The graph below shows US oil production, OPEC oil production, and the oil price. Note what happened in 2014-15.