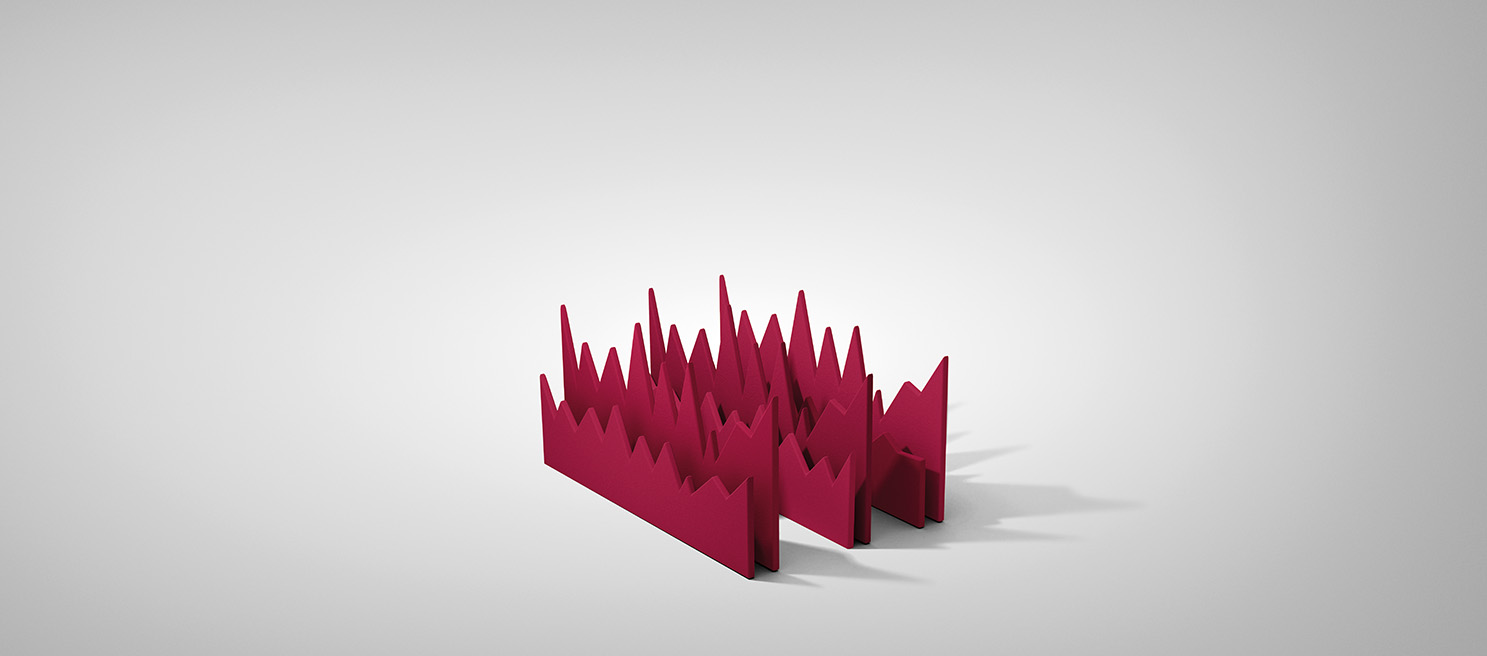

Brent stable at USD 65 as OPEC+ hikes production

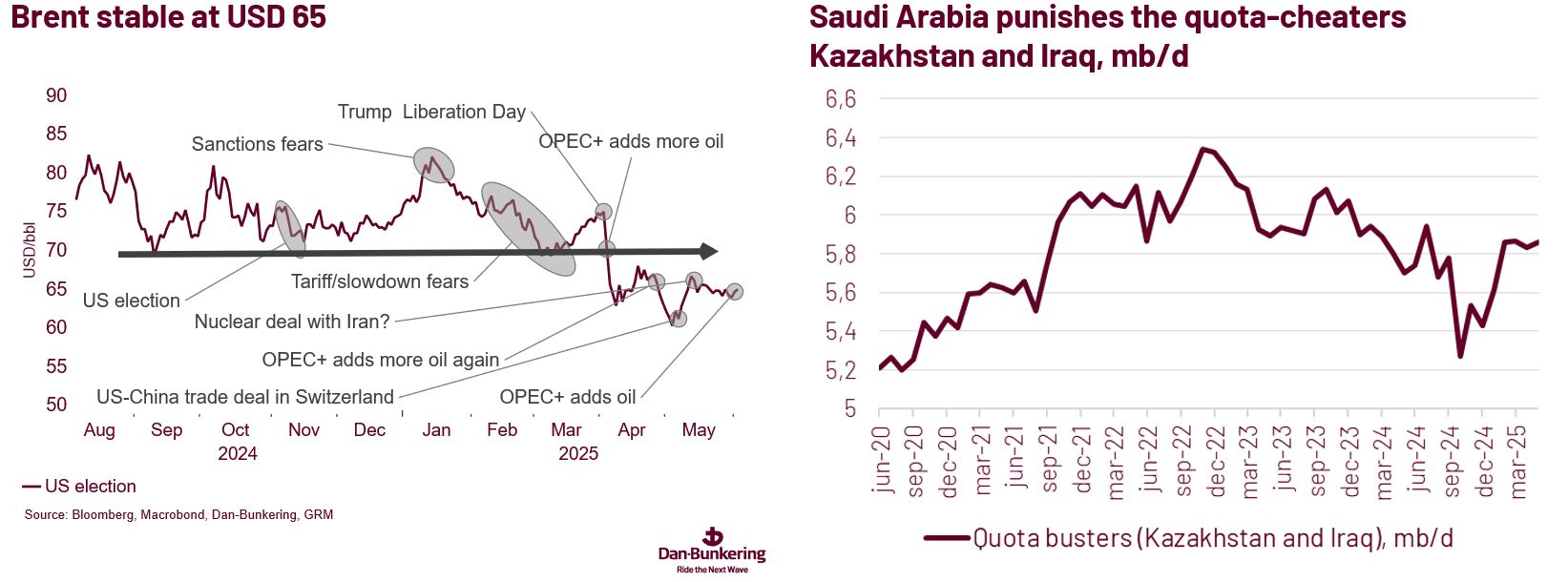

At their Saturday meeting, the eight so-called V8 members of OPEC+ announced a third output increase of 411,000 barrels per day, effective from July 1. That brings the total quota rise since March to 1.4 million barrels. But some of it may never reach the market. Several producers are already over their quotas and have to do compensation cuts, and others are operating at full capacity.

The increase comes as demand in the US (driving season) and power demand in the Middle East (due to air conditioning) both rise. Notably, some Gulf power producers may opt to burn crude instead of fuel oil to offset the increased production, as fuel oil remains almost as expensive as crude.

Brent has rebounded by nearly 4% since the announcement, to around USD 65. Hence, the oil market shrugged off new US tariff hikes on steel and aluminium, also announced over the weekend.

We expect one final OPEC+ quota increase to be decided on 6 July. After that, OPEC+ is likely to pause. Some members, including Russia, Oman, and Algeria, reportedly opposed the latest move. That may indicate that a pause is getting closer.