Expensive HSFO and less tariff fears

In this issue, we discuss the implications of the US tariffs on Canada and Mexico being on hold for a month and the strong HSFO market.

In this issue, we discuss the implications of the US tariffs on Canada and Mexico being on hold for a month and the strong HSFO market.

Singapore

The Asian LSFO market is expected to find support this week due to rising downstream demand after the Lunar New Year. Limited arbitrage inflows are expected into Singapore, with bunker demand rising, but slowed by holidays.

The Asian HSFO market remains supported by limited prompt supply availability, with HSFO barge availability tighter than usual, which boosts downstream premiums.

The Asian gasoil market is expected to have tight arbitrage supplies into Singapore, with demand growing but likewise tempered by holidays.

ARA

Opening on HSFO from Europe/Med to the East so bullish view on this grade.

Fujairah

Demand remains very sluggish post Lunar New Year across all grades.

Barge avail lead times have reduced with some prompt slots now available. HSFO still has some pockets of tightness up to 9th Feb.

Houston

The Houston Ship Channel is currently in Fog Season (October - March) and delays may occur due to channel closures and/or traffic.

Gibraltar

The weather has improved and no backlog exists.

EDD for VLSFO in ALG is 9th - so urging you to show inquiries as early as possible.

Due to illness, the South African ports did not report this week.

For port availability and demand, download the full report here.

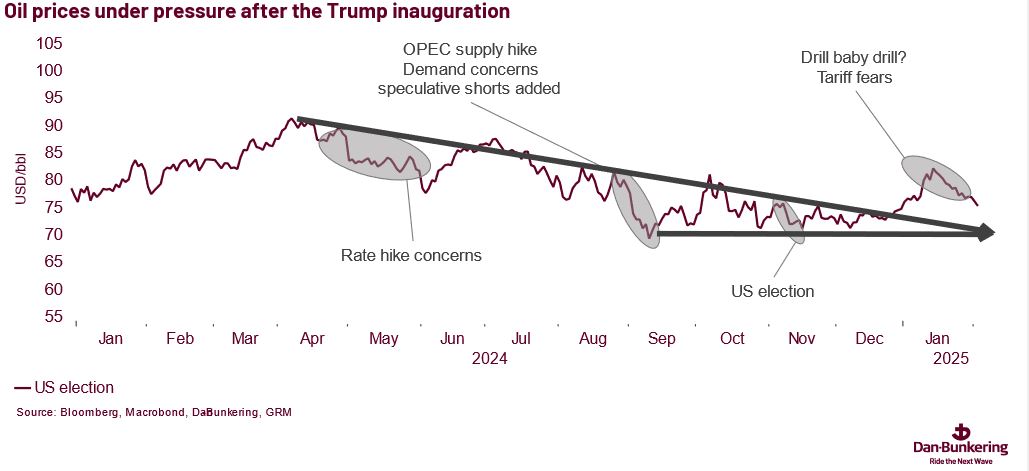

The unpredictability of Trump’s policy and its impact on the global growth outlook also make the outlook for oil prices very uncertain.

We still hold the view that prices will move higher in Q2 and Q3 as focus turns to sanctions. However, if sanctions are not tightened, the expected increase in Brent will likely not materialise.

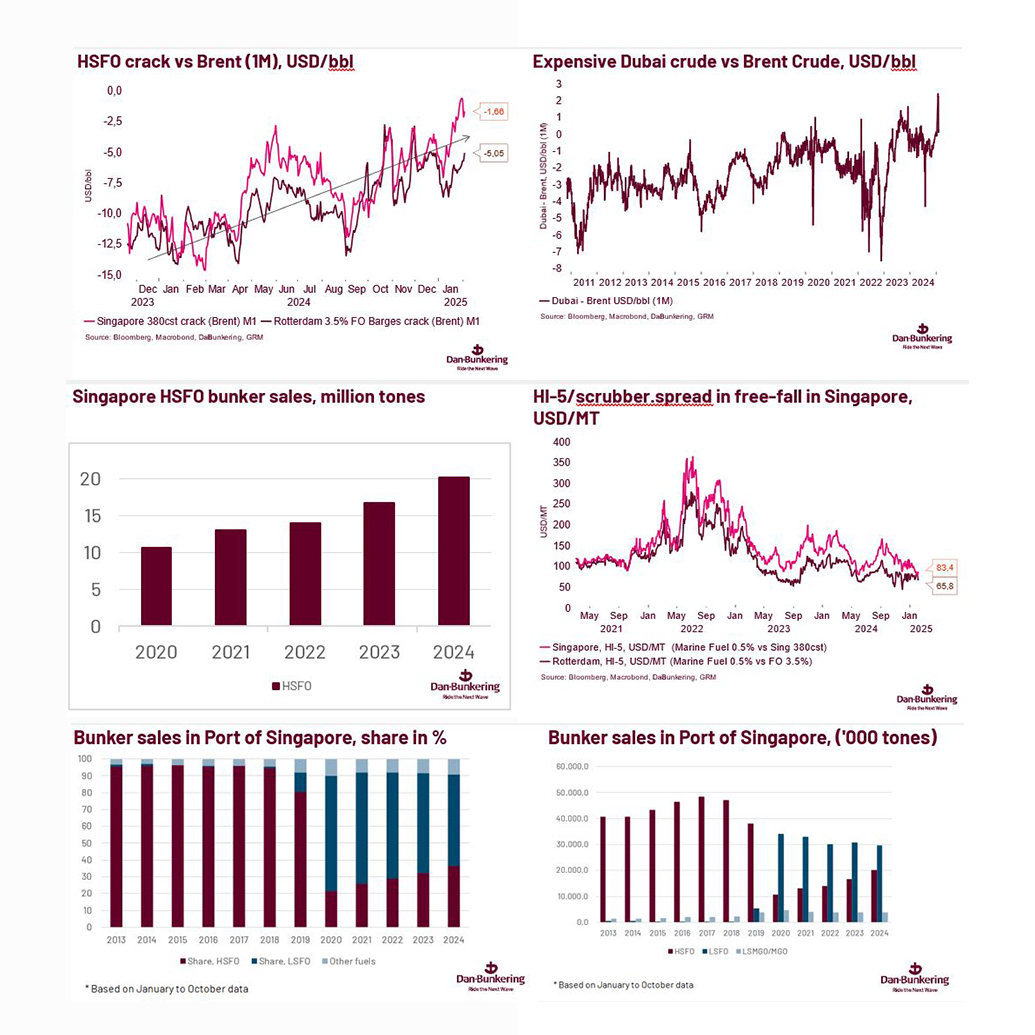

HSFO (3.5%) has become expensive. Over the past few weeks, the price of HSFO (3.5%), particularly in Singapore, has risen significantly relative to Brent (i.e., the crack has become less negative). The front crack in Singapore has briefly been trading close to zero, indicating that HSFO is almost as expensive as Brent crude oil.

The stricter sanctions on Russia have reduced the availability of heavy/sour crude oil and residuals in the Asian market. This can be seen in the widening spread between Dubai and Brent oil. Usually, Dubai crude trades below Brent. However, due to Asian refineries seeking alternatives to Russian-sanctioned oil, the price of Dubai crude has been driven higher.

We also expect Saudi Arabia to lift the so-called OSP (Official Selling Price) to Asia by USD 2. Saudi oil is sold at a fixed spread to the Dubai-Oman benchmark, and a higher OSP reflects improved demand for non-sanctioned oil.

At the same time, demand from the maritime sector remains strong, particularly in Singapore. HSFO bunker sales rose 15.8% year-on-year in Q4 and 20.5% year-on-year in December alone. Bunker sales of HSFO in Singapore have almost doubled since 2020, when IMO regulations made scrubber installations mandatory for HSFO users.

We expect HSFO prices to remain high, particularly in Singapore, but there is also a growing risk that Rotterdam prices will be pulled higher.

A possible reopening of the Red Sea could ease some pressure on the HSFO market as the focus in the coming months shifts toward the peak-demand summer season, when HSFO demand in the Middle East for power production and bitumen consumption typically increases.

The strong HSFO market has also pushed the HI-5 (scrubber spread)—the difference between HSFO and VLSFO—significantly lower. The HI-5 represents the savings of using a scrubber on a vessel.

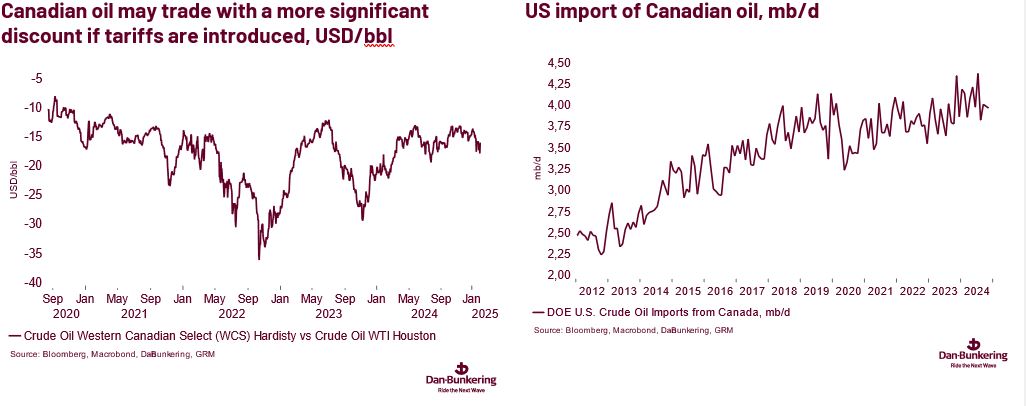

Over the past week, the oil market has focused on whether the announced tariffs on Canada and Mexico would take effect today. However, yesterday, at the very last moment, Trump reached an agreement with Mexico and Canada.

Both countries have promised to deploy military forces to the border to curb fentanyl smuggling and human trafficking. The postponement is temporary, lasting for one month.

As a result, the discussion on tariffs for Canada and Mexico may resurface in a few weeks. Therefore, it remains relevant to assess the potential impact if tariffs are introduced at a later stage.

Canada exports approximately 4 million barrels of oil per day to the US, while Mexico exports just over 700,000 barrels daily.

Since US refineries in the Midwest rely heavily on Canadian crude, tariffs on oil could lead to higher prices for refined products in the US. It may also prompt US refineries to source more oil from the global market, while Canada could seek to export more crude internationally. However, both scenarios face logistical constraints. The Canadian oil industry is primarily structured around exports to the US, and Midwest US refineries are specifically configured to process Canadian crude.

If 25% tariffs—or export duties—are introduced at a later stage, oil prices may initially spike due to an increased risk and logistics premium. However, tariffs of this magnitude would dampen global growth and risk appetite, adding downward pressure on oil prices. Therefore, the overall effect remains uncertain.

Given recent developments - particularly Trump's apparent support for sanctions on Russia, Iran, and Venezuela - there remains a risk that the market could be surprised by the upside, especially in Q2 and Q3.

Hence, we still expect Brent to trade in the USD 72–92 range in 2025. The wide range reflects increased uncertainty and the upside risks associated with sanctions. We see OPEC+ delaying plans of more oil if Brent trades below USD 72. It creates a floor under prices in 2025.