OPEC+, Stagflation Fears, and Trump’s Tariffs Drive Oil Prices Down

Last week, we noted that the oil market had remained surprisingly calm over the past couple of weeks despite various influencing factors. We asked whether this was the calm before the storm. It was—the storm arrived this week.

Brent fell by approximately two US dollars to just below USD 71.5 yesterday. Prices have continued to be under pressure today and are trading just above USD 70.0 this afternoon. Hence, we are testing the floor for oil prices in 2024, apart from a brief dip below USD 70 in September.

We may see oil prices remain under pressure in the coming days, depending on whether risk appetite (the stock market) rebounds. A close below USD 70 could open the door to further price declines.

In this edition, we discuss three factors that have weighed on oil prices recently:

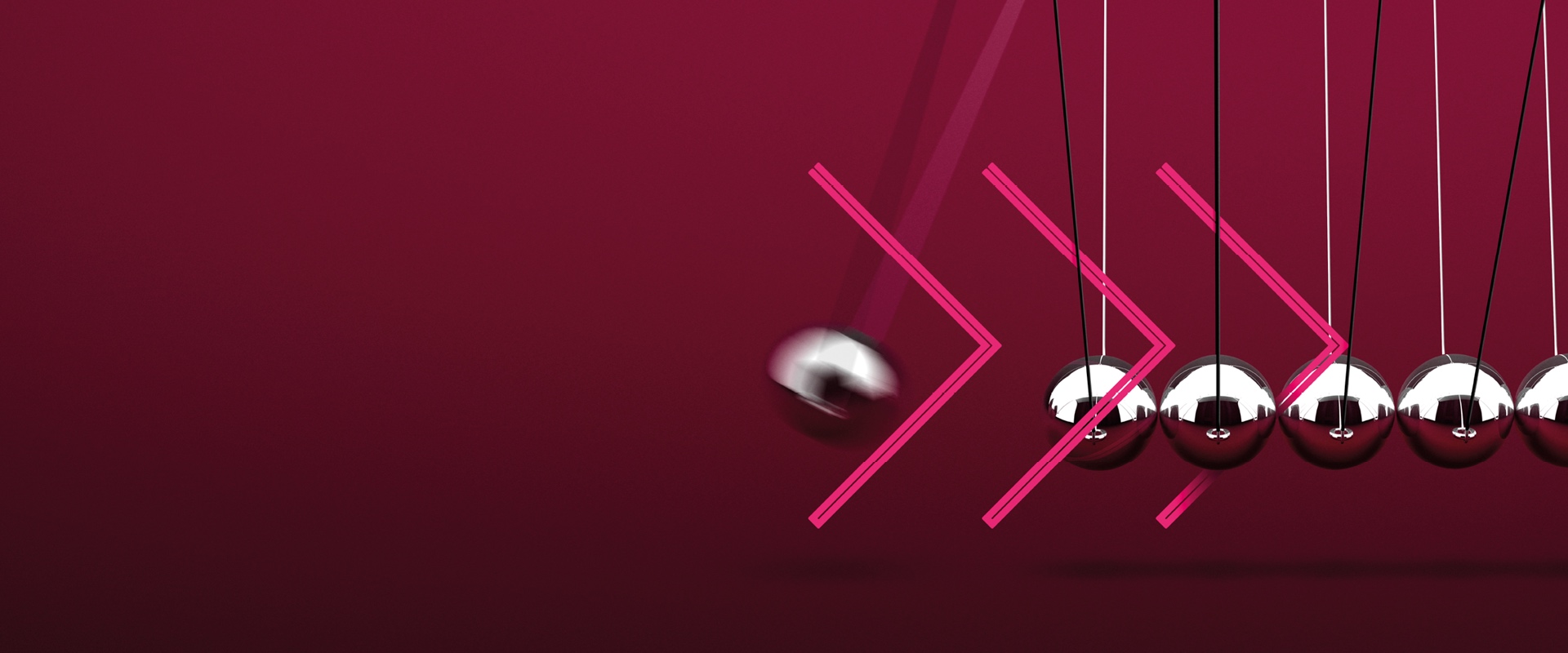

- OPEC+ announced that the plan to add more oil will begin on April 1

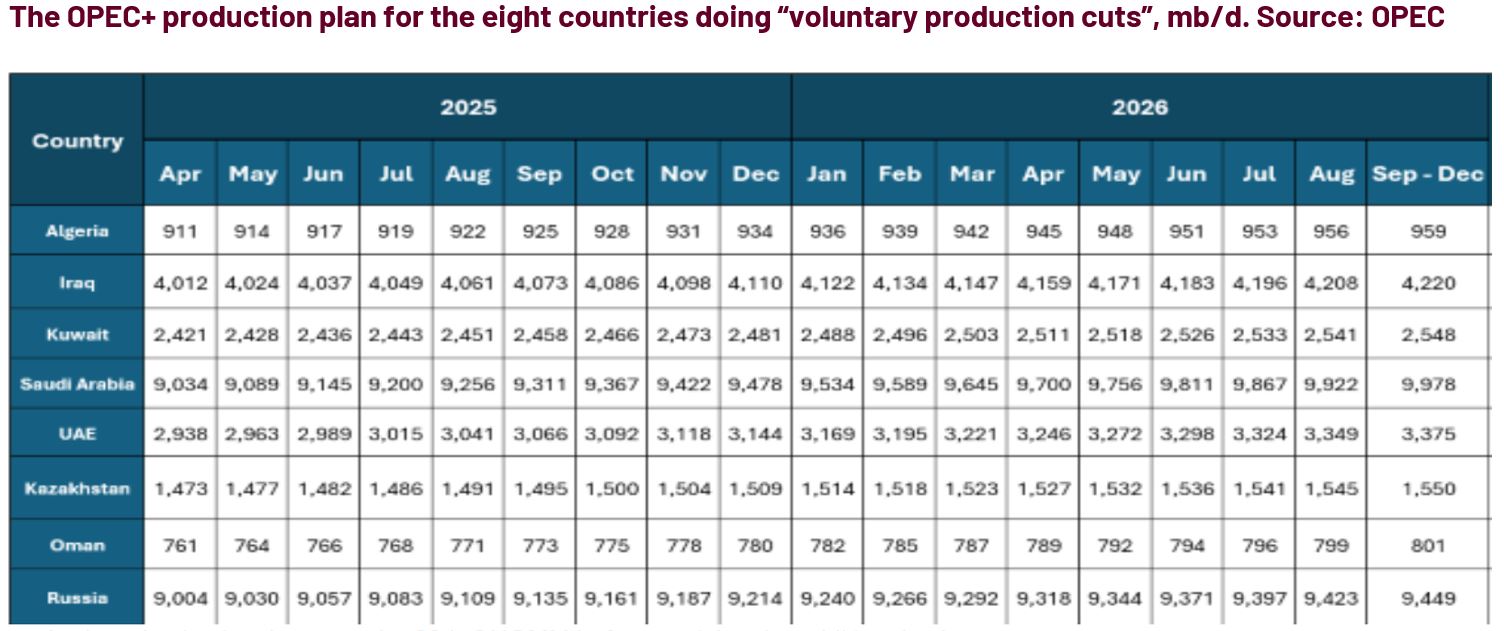

- Recent weak US data as the economy reacts to fears of tariffs

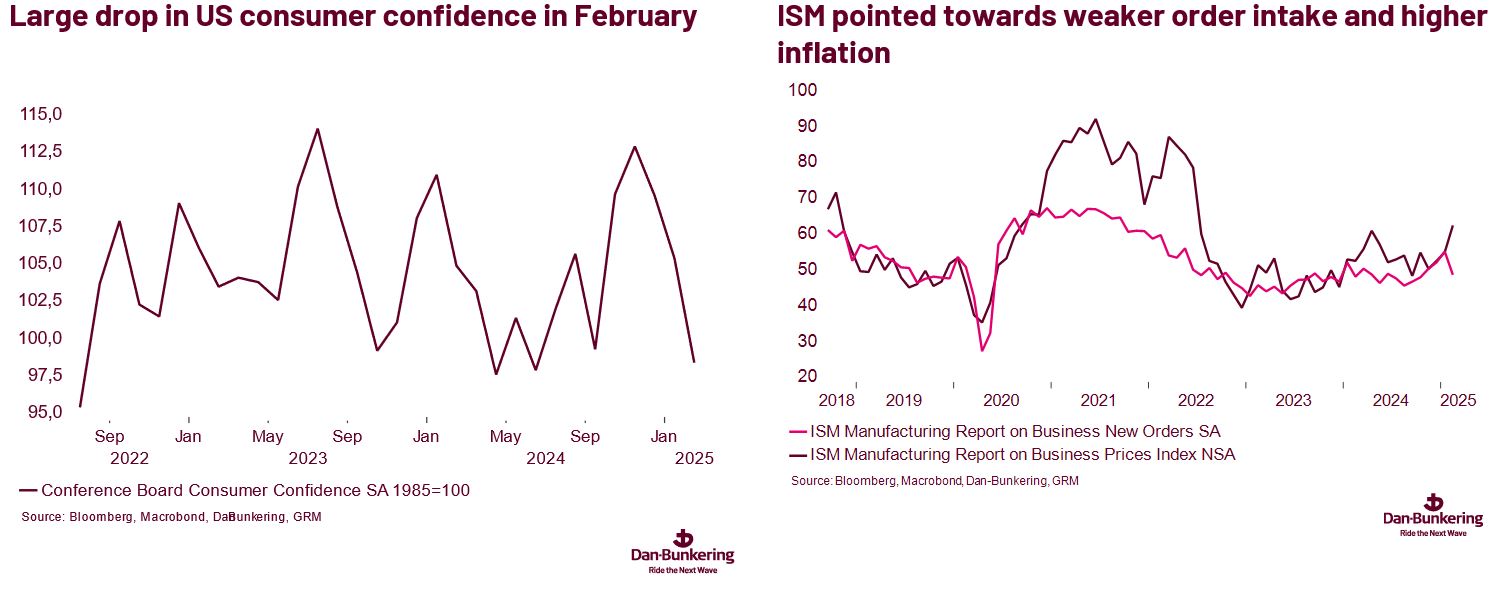

- The halt of US military aid to Ukraine and expectations that the US will lift Russian sanctions

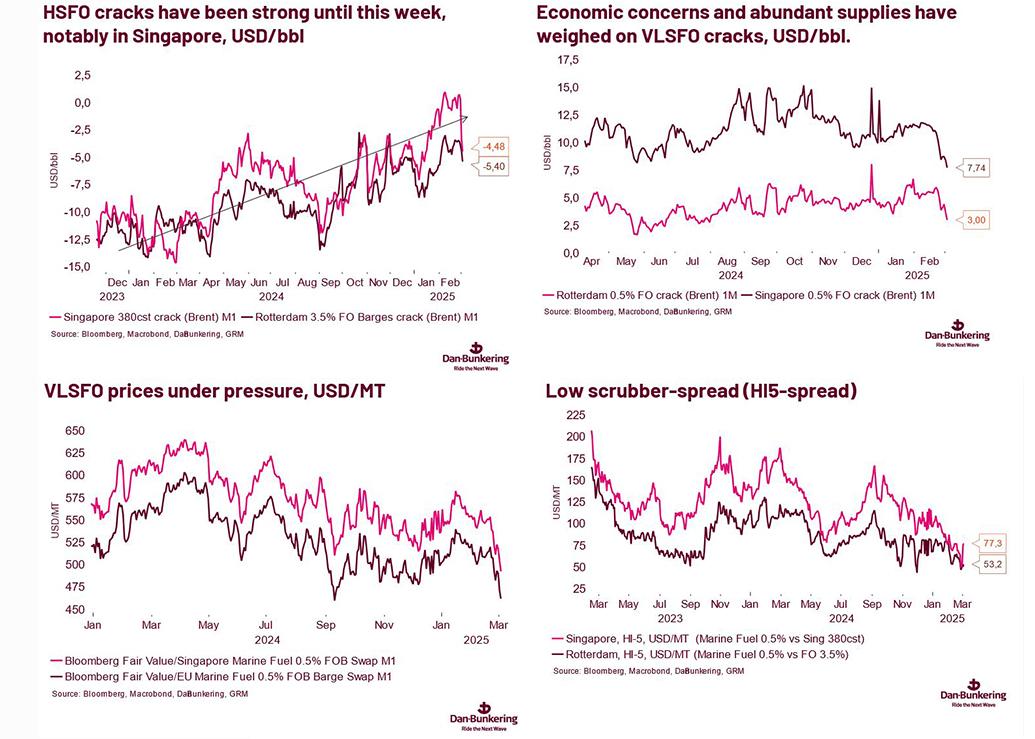

We also take a closer look at the divergence between VLSFO and HSFO, which has pushed the HI-5 spread, also known as the scrubber spread, to new lows. Given recent developments, we have revised our Brent oil price forecast lower for Q2 and Q3, averaging USD 74, down from the previous USD 78.