OPEC+ adds even more oil to the market, and HSFO remains expensive

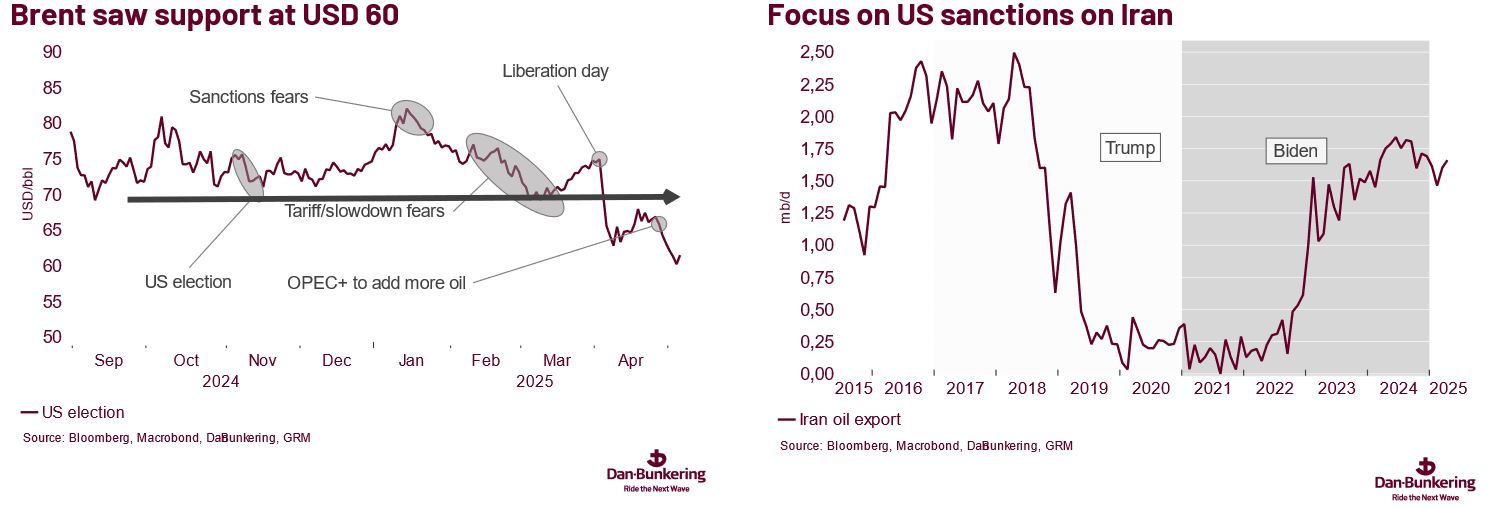

Last week, we argued that we are seeing signs of stabilisation in financial markets after the “Liberation Day” rollercoaster in the oil market and other markets at the beginning of April.

We might have seen some stabilisation in financial markets in general. Oil prices, on the other hand, remain under pressure. Brent is trading around USD 61.5 after trading above USD 67 in mid-April and as low as USD 59 yesterday morning.

The big market driver over the last week has been OPEC+ and the announcement on Saturday that oil production will be hiked by another 411,000 barrels per day in June.

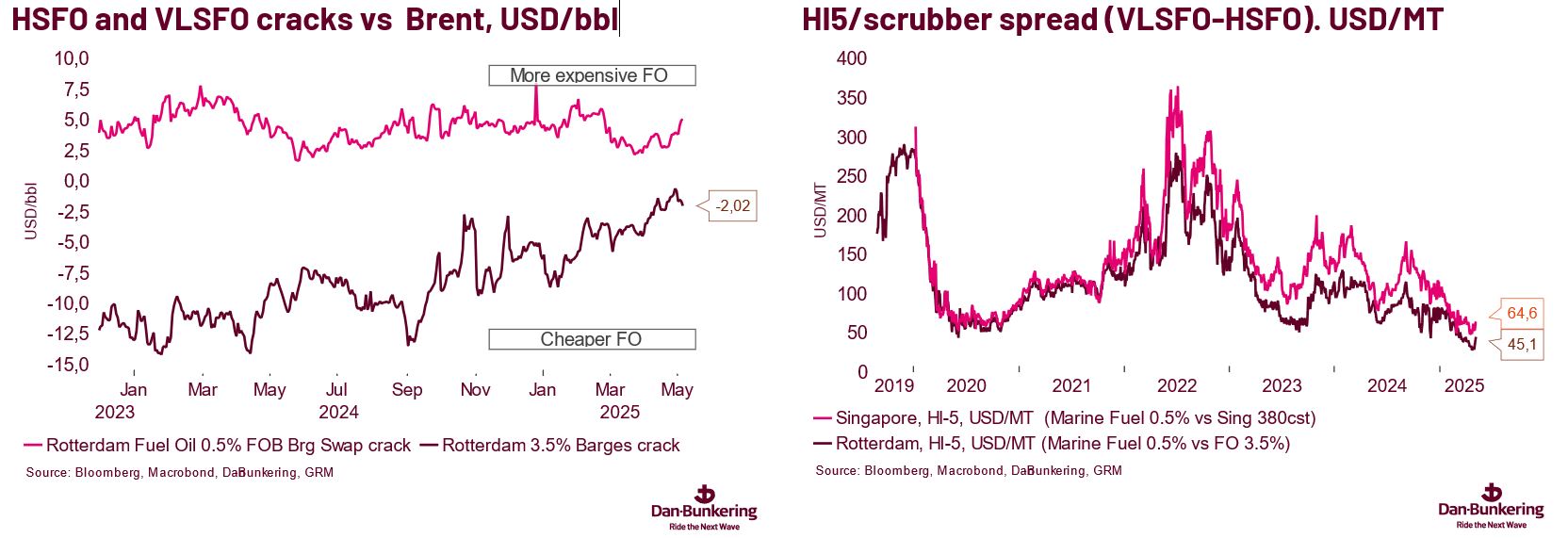

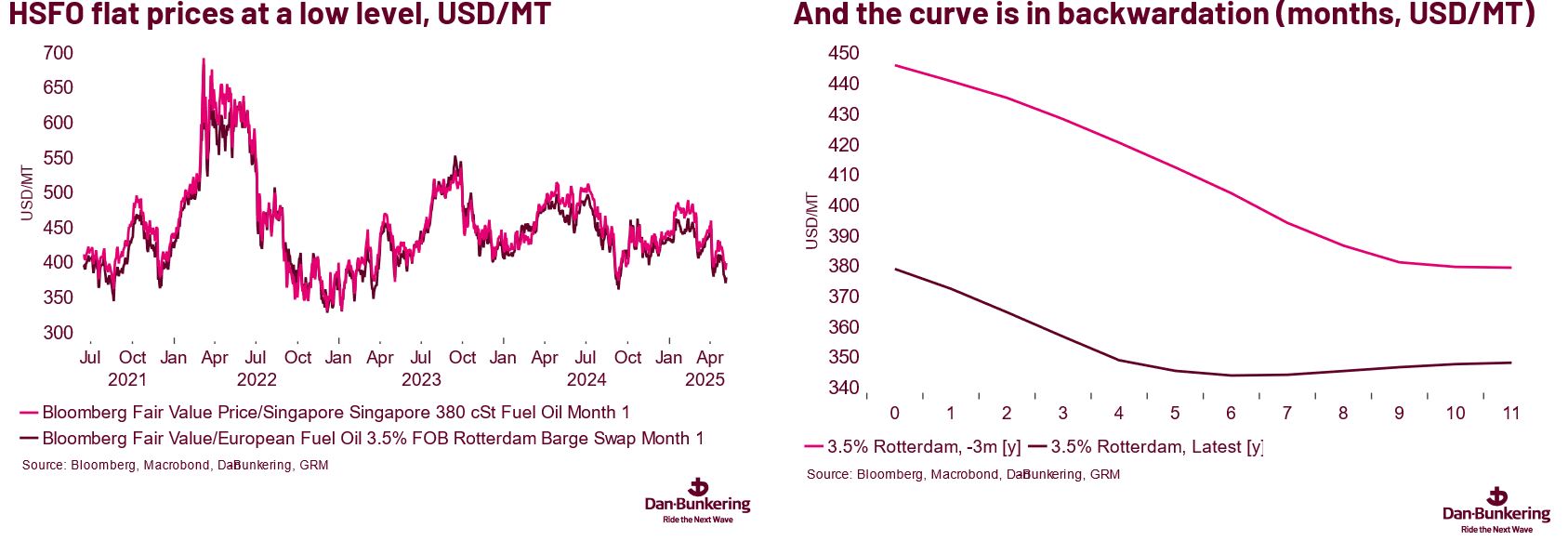

In today’s issue, we discuss the market outlook after the OPEC+ announcement, and we also take a closer look at the drivers in the HSFO market and why HSFO are expensive relative to VLSFO and Brent.

Overall, we reiterate that we see strong support for Brent in the USD 60–64 range. However, with the stabilisation of financial markets, we may, on the one hand, slowly return to the USD 70 level over the coming three to four months. On the other hand, the OPEC+ announcement and the likely slowing of the world economy speak in favour of lower oil prices.

Hence, in today's issue, we take a closer look at,

- Why did OPEC+ decide to hike oil production?

- Why is HSFO expensive on a relative basis?