Oil price drivers 2025

In this first issue of our Weekly Market Report in 2025, we take a closer look at the latest rally in oil prices.

In this first issue of our Weekly Market Report in 2025, we take a closer look at the latest rally in oil prices.

Singapore

The Asian LSFO market is expected to rise moderately this week driven by recovering bunker fuel demand and reduced Western arbitrage arrivals, which tighten regional stocks.

The Asian HSFO market is supported by steady bunker fuel demand, though ample supplies and seasonal utility demand weakness continue to pressure fundamentals.

The Asian gasoil market is likely to stay supported, driven by a bullish near-term demand outlook and reduced cargo arrivals, as arbitrage economics are unfavourable.

ARA

Steady market at the minute as we come off a quiet Christmas/New Year period. Gasoil demand has increased, and suppliers are far more aggressive as we reach bigger discounts this week. Overall, our outlook is positive with good avails for prompt demand.

Fujairah

A quiet Christmas and New Year period in the region, with slow and tepid demand. However, with winter winds and high swells, Fujairah port saw disruptions and barge delays for the first few days of 2025. Suppliers have worked through the backlog well and supply has resumed to normal.

Houston

Avails are tight across all grades due to low inventory from the end of 2024. Avails will remain tight until bulk resupply replenishes

Port of Houston is under winter weather watch. A cold front has brought high winds and near-freezing temperatures. Vessel arrivals and sails as well as barge movements expected to be impacted this week. Deliveries to bolivar roads and offshore have been intermittently suspended due to wind and unfavourable sea conditions

Dense fog is also present overnight and early AM hours. This is common for the US Gulf this time of year and is expected to continue until early spring.

Port Louis, Walvis Bay and Durban did not report today.

For port availability and demand, download the full report here.

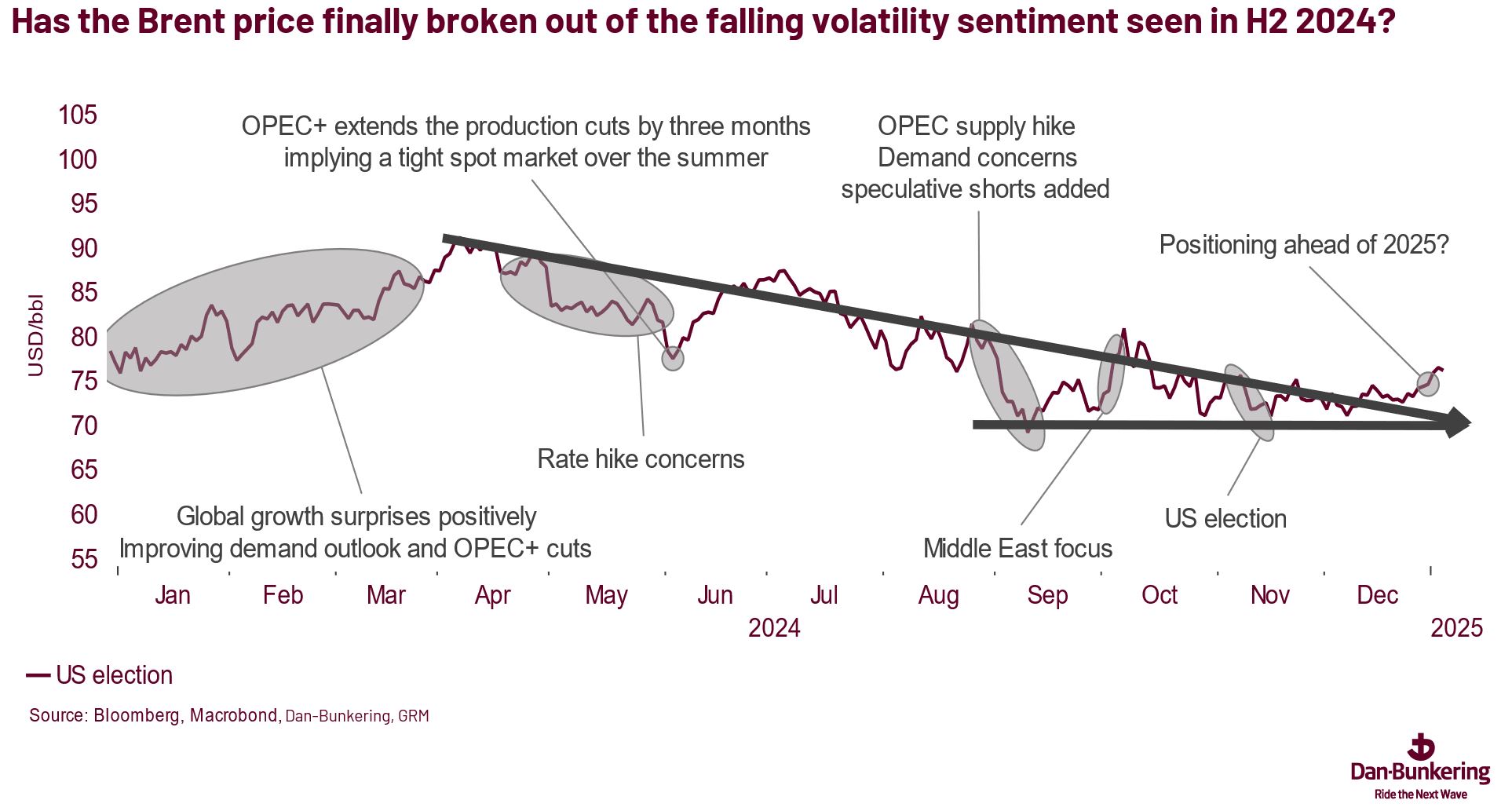

Brent has risen more than three US dollars over the last two weeks and is trading just above USD 76, the highest level since October last year. However, one should always be careful during the Christmas and New Year trading days. The market is illiquid and prone to erratic moves.

However, the last and first trading days of a year also provide valuable information about investor sentiment. Positions are closed before the new year, and new positions are opened in the year's first days. Hence, it seems that investors have decided to close some of the many short oil positions in the market and may even have entered new long positions—a very different picture compared to most of 2024. Following the weekly CFTC positioning data in the coming weeks will be essential. The data are published on Fridays after the US closes.

But it is still early days, and as mentioned above, price moves should be taken with a pinch of salt. Still, we would point to these price drivers to watch going into 2025.

OPEC+ has postponed plans to increase oil production three times in 2024, and additional delays are possible. There is a limited capacity for additional oil from the cartel in 2025 if it aims to maintain stable or higher prices. OPEC+ is currently following a "price strategy." If it decides to produce more oil, the market might interpret this as a shift toward a "volume strategy" or "market share strategy," potentially reducing prices to around USD 60 per barrel. This situation may lead OPEC+ to accept further reductions in market share in 2025.

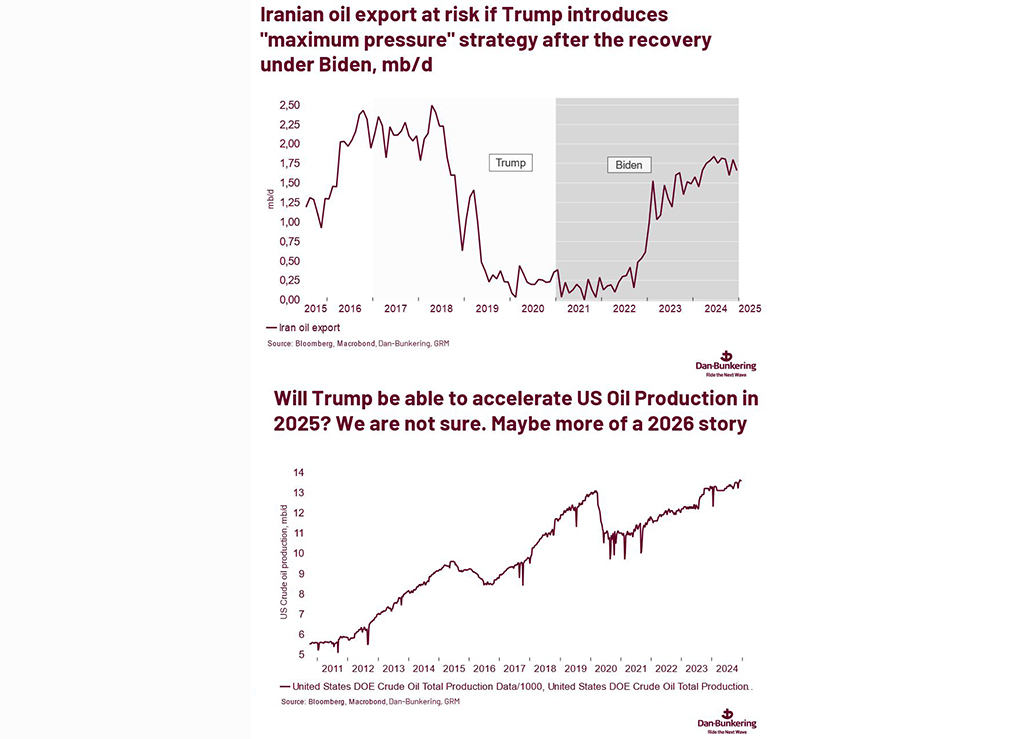

Mike Waltz, Trump’s national security adviser, has stated that the US must revert to a "maximum pressure" policy on Iran, mirroring the approach taken during the final two years of Trump’s first term.

Stricter sanctions on Iran are expected to reduce Iranian crude oil exports by between 0.5 and 1.0 mb/d, currently at around 1.75 mb/d.

Additionally, the surrender of the Houthis could become a notable development, as they will no longer receive the same military support from Russia and Iran. The reopening of the Red Sea could be a positive surprise in 2025.

Trump has championed the slogan "Drill, baby, drill." He may aim to remove regulations, streamline permits, improve infrastructure, and offer tax incentives for fossil fuel development, all of which would make capital more accessible.

However, a significant increase in U.S. oil production in 2025 may be unlikely. High interest rates and investors focusing on dividends could hinder any growth.

China could be the positive surprise of 2025 as its stimulative measures begin to take effect. However, the structural outlook is quite different. China's oil demand growth will remain modest with the continued adoption of electric vehicles and LNG-powered trucks. Once again, North America and the rest of Asia, particularly India, will drive global oil demand in 2025.

We note that Saudi Arabia yesterday hiked the so-called Official Selling Price, OSP, to Asia for the first time in three months. A higher OSP is normally seen as a sign of improved demand.

We expect Brent oil to trade within a tight USD 68-82 range in 2025. It’s easy to argue for a bear market for oil in 2025. However, with relatively low global oil inventories, OPEC+ eager to push prices higher, and new sanctions on Iran, there is a risk that the market might be surprised on the upside. From a positioning perspective, this could catch the market off guard.