OPEC+ and Trump a bad combination for oil prices

It has been a very hectic week since our last issue in oil and bunker markets, and unsurprisingly, Trump once again took the limelight. More surprisingly, OPEC+ also added to the bearish market sentiment.

On Thursday and Friday, we experienced the most significant percentage drop in oil prices since March 2022, when Brent prices fell from above USD 75 to below USD 65.

We have also seen that the support level at USD 70 has effectively collapsed. The latter implies we are in unchartered territory regarding Brent oil prices in the short term.

In today's issue, we take a closer look at:

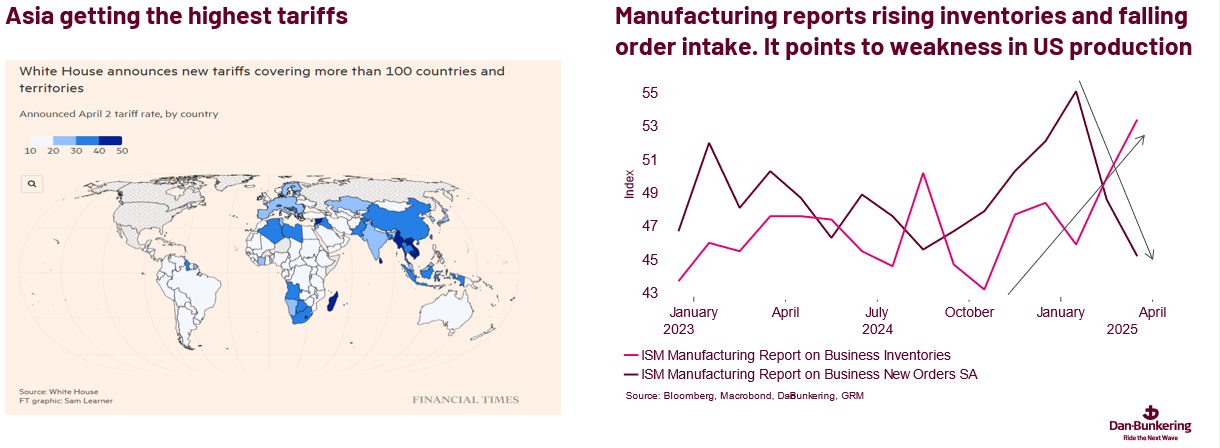

- the impact of the US tariffs announced this week

- the OPEC+ decision to add more oil to the market May 1

- China retaliated and added 34% tariffs on US goods

- Potential factors that could break this negative spiral for oil prices