Forget about OPEC - now It's all about geopolitics

Our economist is at the SIBCON conference in Singapore, so the editorial deadline for the text is Sunday, October 6. Note that there will be no Weekly Market Report next week.

In our latest report from September 27, we discussed three key developments that would drive the oil price in the short term. We argued that Saudi Arabia is flirting with a volume strategy, that Libyan oil will return to the market, and that China has taken out a "small bazooka" to support its economy.

The OPEC+ meeting last week essentially confirmed that OPEC+ still plans to add more oil on December 1, signalling a shift towards a volume strategy. However, the cartel is putting considerable effort into improving quota adherence from the quota busters: Iraq, Kazakhstan, and Russia.

Libya also confirmed that oil production will be restarted following the election of a new central bank governor. Hence, two bearish pieces of news. In terms of China's monetary and fiscal easing, China has celebrated Golden Week, and we are waiting to see if consumer confidence and spending have improved in light of the easing measures.

But to be honest, last week all focus has once again turned on geopolitics and for a change, not on OPEC or the Chinese growth outlook.

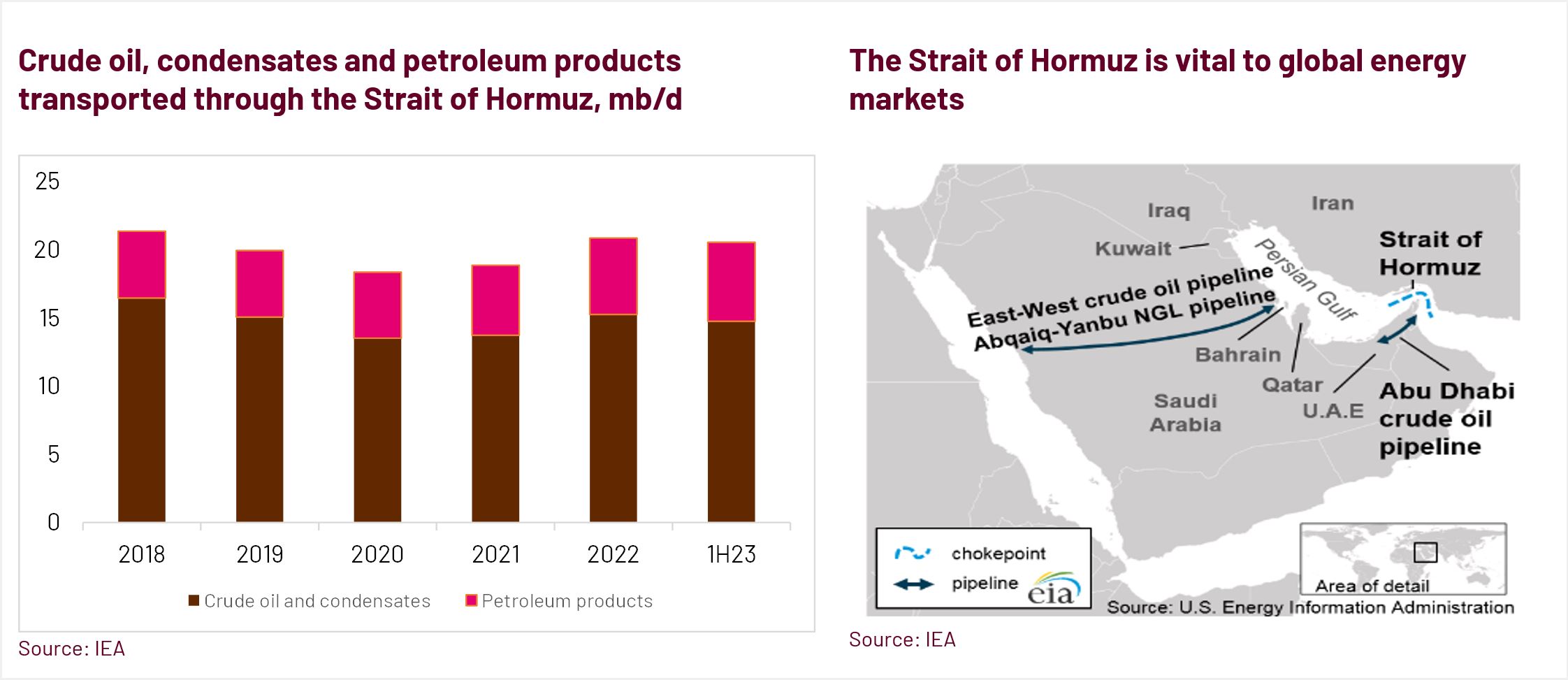

We are writing this report on Sunday afternoon, and the market is facing a lot of uncertainty ahead the next couple of days. Many Middle East experts now foresee an Israeli retaliatory attack being imminent. It seems that Iranian oil installations might be targeted.

Below, we discuss the geopolitical situation and outline some scenarios for Brent oil prices.