Oil market: Bearish oil market reports and risk to the upside for gas oil, diesel and MGO cracks

In this edition of Energy Market Drivers, we discuss the latest oil market reports from IEA, EIA and OPEC and the latest developments in product cracks.

In this edition of Energy Market Drivers, we discuss the latest oil market reports from IEA, EIA and OPEC and the latest developments in product cracks.

Singapore

The Asian LSFO market is expected to remain rangebound as ample near-term supplies offset a limited increase in bunker demand. Expect limited barging slots for early refuelling dates, which may support the prompt LSO bunker premiums, though volatile demand could present risks to overall valuations.

The Asian HSFO market is expected to remain particularly supported by regional feedstock demand and the late summer power generation demand in the Middle East. However, some are concerned the increasing supplies could pressure fundamentals in the coming weeks.

The Asian gasoil market may remain rangebound as market participants hold mixed views on supply tightness, although stable demand may lend support to the ultra-low sulphur diesel segment.

ARA

Market is well supplied.

Fujairah

The VLSFO market in Fujairah remains very tight with the continued Sudan blockade preventing Sudan crude from being imported into Fujairah, a main feedstock for the Fujairah based refineries.

Lead times now 8-10 days for inquiry with some suppliers tight balance Sept.

HSFO is tight for up to 20th Sept with avails balanced after this.

New York

Demand in Q4 seems to be ticking up on contract.

Panama

Light inquires today.

Port Louis

A quiet week in Port Louis. Some suppliers stating some tight avails for next days.

Durban

The muted demand continues, with minimal inquiries and a quiet market overall.

Walvis Bay

The Sub-Saharan market across the board continues to remain quiet, with overall bunker calls being few and far between.

New York will report later today.

For port availability and demand, download the full report here.

The IEA report, published last Thursday, once again highlighted that a significant oversupply of oil is expected in the coming quarters, particularly after OPEC+ has decided to unwind the second layer of production cuts, amounting to 1.65 million barrels per day (mb/d).

In 2026, the IEA now expects the oversupply to reach a record 3.33 mb/d, which is nearly 0.4 mb/d more than projected a month ago. We have to go back to the height of the pandemic in 2020 to see a similar inventory build.

The IEA report also stressed that if it had not been for Chinese stockpiling, the inventory build in the OECD area would have been significantly larger this year. China continue to be the big unknown in the oil market. Nobody really knows how much oil China have been stockpiling. The IEA says that,

“Global observed oil inventories rose for the sixth consecutive month in July. The 26.5 mb increase in July puts the cumulative growth since the start of the year at 187 mb. Chinese crude stocks rose by 64 mb over the same period – and by 106 mb from February to August, helping absorb the overhang. “

The report followed the EIA report published the day before, which assessed that the expected massive inventory build was already underway and had started earlier than expected. EIA reiterated its expectation that Brent will fall below USD 50 in early 2026, based on a significant inventory build.

EIA operates under the US Department of Energy, and the 50-dollar forecast happens to match Trump’s campaign promise of lower oil prices. EIA also projects that US oil production will remain stable or decline from here, in clear contrast to Trump’s “drill, baby, drill” rhetoric. However, the verdict is still out with respect to US crude oil production. Growth may have stalled, but we still haven’t seen any significant pullback despite the number of oil rigs continuing to edge lower. Higher productivity keeps production running, and US production has edged higher over the last four weeks.

The OPEC report, on the other hand, was unsurprisingly more positive. The cartel estimates that OPEC+ needs to produce 43.5 mb/d in the second half of the year (call on OPEC+) if inventories are not to decline. In August, OPEC+ produced 42.4 mb/d. This points to a very different market balance which, in contrast to the IEA and EIA, indicates an inventory draw unless production is increased.

Taken together, last week’s three oil market reports have reinforced that the market is heading towards a significant inventory build in Q4 and in H1 2026. Unless new geopolitical developments emerge, oil prices are likely to drift lower.

The IEA express it this way,

“Oil markets are being pulled in different directions by a range of forces, with the potential for supply losses stemming from new sanctions on Russia and Iran coming against a backdrop of higher OPEC+ supply and the prospect of increasingly bloated oil balances.”

On the geopolitical front, the market awaits any possible stepped-up sanctions on Russia after at least 19 Russian drones flew deep into Polish territory last week.

However, there is little indication that the U.S. will tighten sanctions. Trump’s response to the 19 drones entering Poland: “It could have been a mistake.”

However, the US is ready to impose sweeping tariffs on China of up to 50% or 100% if the rest of the G7 countries join in. But the US knows that the EU cannot, from one day to another, impose sanctions and higher tariffs, notably, as Hungary and Slovakia will likely block any such initiatives.

That said, the European Commission is preparing a new sanction package. Reuters says that the new package may include independent Chinese refineries. The current sanctions, which need to be confirmed every six months, were extended last week.

However, as we have written before, the most effective “sanctions” against Russia are the Ukrainian drone attacks on Russian oil facilities. Over the weekend, the Kirishi refinery – with a capacity of 0.4 million barrels per day – and the Novoil refinery – 0.14 million barrels per day – were hit. As always, the Russian authorities claimed that a downed drone caused the fire, even though photographic evidence shows otherwise. The attacks follow last week’s successful strikes on the Primorsk oil export terminal.

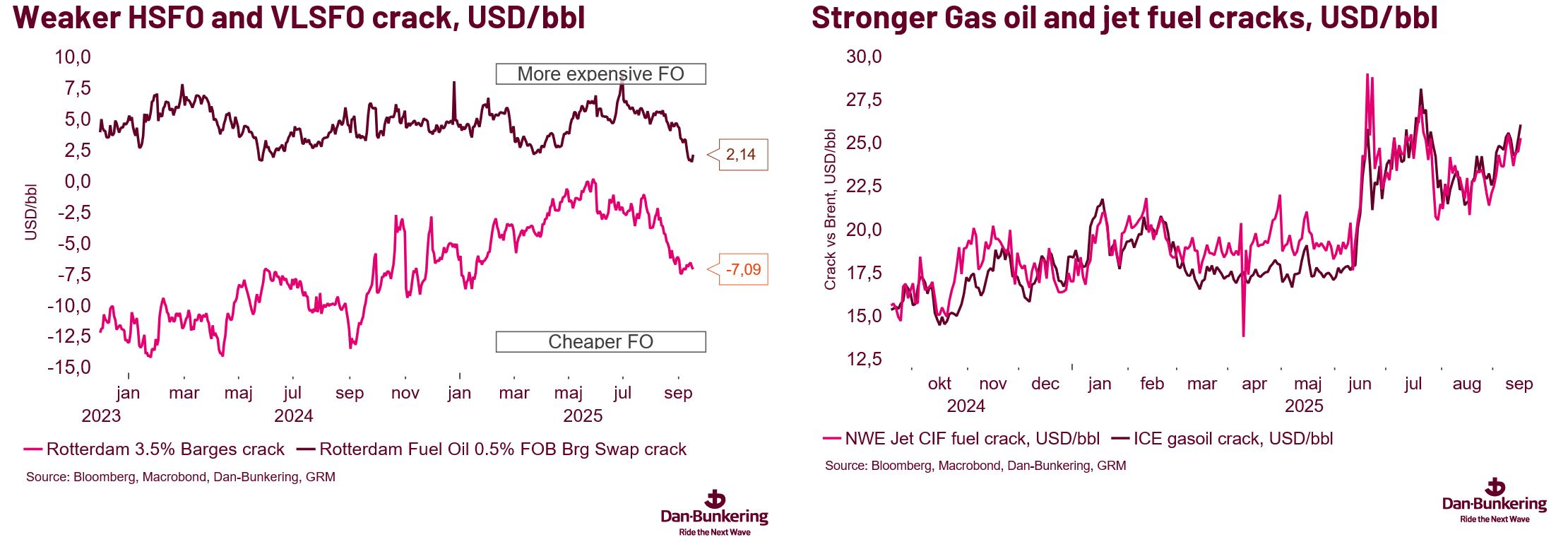

The increased oil supply from the OPEC+ and potentially rising inventories, coupled with sanctions and the Ukrainian drone attacks, are some of the factors driving fuel oil and distillate cracks (diesel, MGO, jet fuel, etc).

Firstly, the higher OPEC+ production of heavy/sour crude will likely lead to an increase in residuals on the market, resulting in a greater supply of fuel oil, particularly HSFO but also VLSFO. Supplies out of China will be important here.

Hence, the recent decline in HSFO and VLSFO cracks may have a final leg to go. That said, we have a suspicion that the rapid cheapening over the last two months was an overreaction.

Hence, for consumers, both HSFO and VLSFO hedging is starting to look quite interesting. There is still some backwardation in the curves, mainly in HSFO. Furthermore, if the EU adds more sanctions on Chinese refineries using Russian crude it could impact VLSFO and HSFO pricing.

Secondly, we have seen stronger distillate cracks (gas oil, MGO and diesel). We are now entering the refinery turnaround season in Europe, and inventories remain modest. If we see tougher sanctions on Indian and Chinese refineries, coupled with the ongoing Ukrainian attacks on Russian refineries ending Russian diesel and gas oil export to the world market, we could have a combination that pushes distillate cracks significantly higher. This is one of the main risks we see for consumers this autumn.