EUA price collapse or temporary correction?

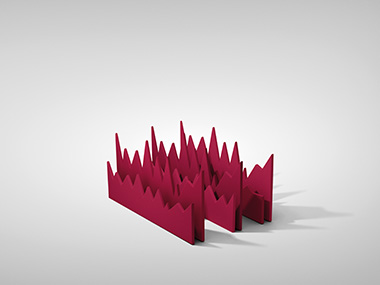

EUA prices have been under heavy pressure over the last couple of weeks, in what could best be described as a toxic combination of rising political risk and a market caught speculative long. Yesterday, the benchmark Dec-26 contract fell below EUR 70/MT, down 25% from the January peak.

Political rhetoric has been the primary driver of the sell-off. Last week, German Chancellor Merz signalled openness to revising or postponing tightening measures in the EU ETS, echoing earlier comments from President Macron, who argued that prices should be closer to EUR 30–40/MT to better balance climate ambition with industrial competitiveness.

Although both Merz and Commission President von der Leyen later defended the system, the cat was now out of the bag regarding political risk in EUA pricing. A risk premium had entered the market well before expected. The European Commission will formally discuss the EU ETS in Q3, but the debate is already public.

This comes, of course, on the back of a European — notably German — energy-intensive industry struggling to keep up with Asian and North American competitors facing lower gas prices and low or no carbon costs. Add US tariffs, a weaker US dollar, and a true hurricane has hit European manufacturing.

At the same time, speculative positioning has clearly been skewed to the long side. This positioning overhang, combined with rising political uncertainty, is a toxic combination that has left the market with a falling EUA knife that few participants are willing to catch.

From a technical perspective, the market appears oversold, with the RSI (technical indicator) below 30. The break below EUR 70/MT was also technically significant and opened downside risk to EUR 63/MT—the April low seen in the aftermath of the Trump administration's trade escalation.

However, for hedgers, the sell-off also offers a buying opportunity. There is a long lag between political rhetoric in the press and actual supply-and-demand changes, supporting taking advantage of lower prices for compliance hedging in 2026 and possibly 2027.

That said, the market remains highly nervous, and the long speculative positioning may have exaggerated the move lower. Yes—the EUA price may have collapsed, but it may prove temporary.