Bearish factors drive oil lower

It has been another eventful week for the oil market, and once again, Trump and his administration have played a key role.

This week, there are no major events scheduled. Hence, it will be another week focused on geopolitics, including the situation in Ukraine and tariff news.

Over the last week, we have generally seen a bearish tone in the market, with Brent trading as low as USD 74 On Thursday after trading above USD 77 the day before.

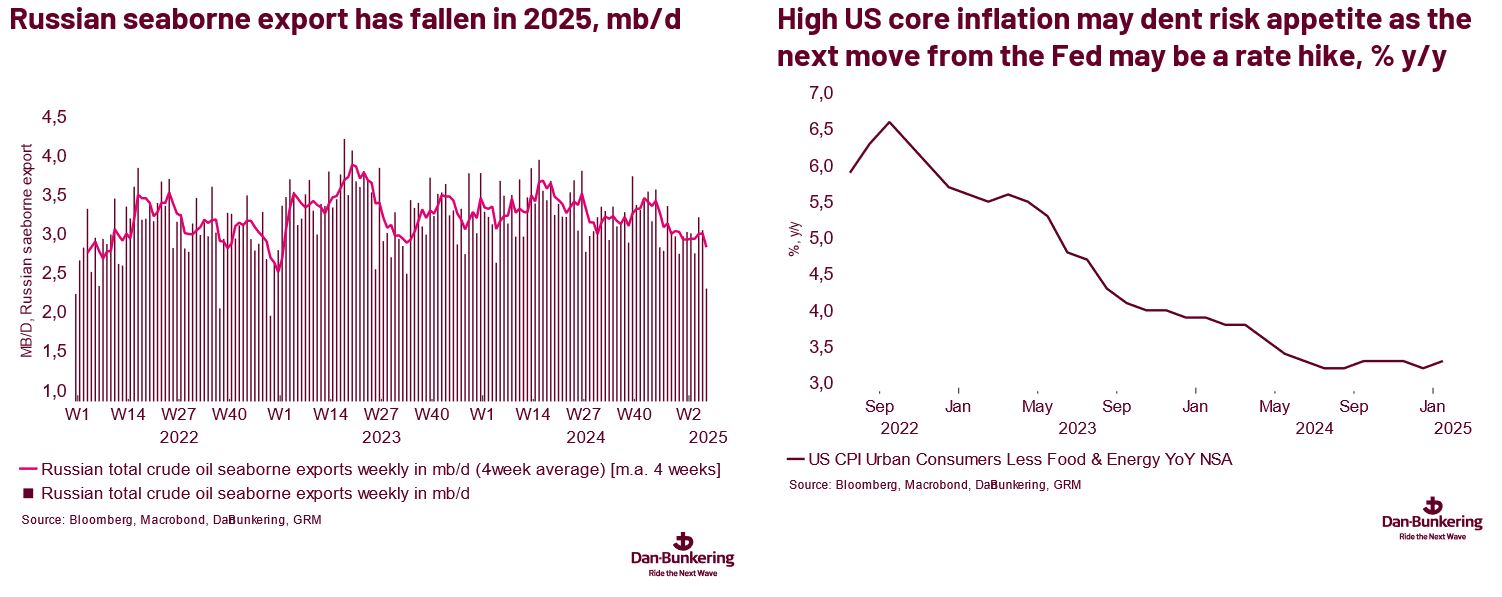

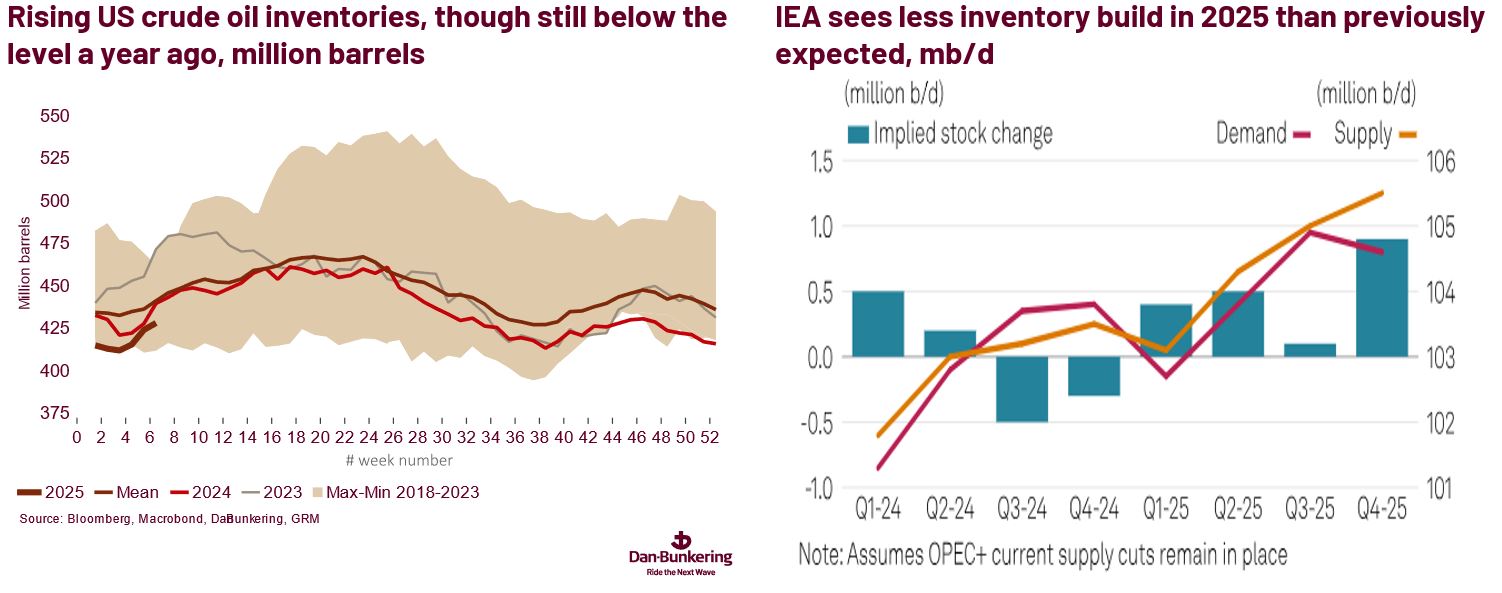

We still expect Brent oil prices to be higher in Q2 and Q3 as the impact of sanctions on Russia, Venezuela, and Iran—particularly on Iran—is expected to affect the global market balance.

However, as discussed below, the likelihood of Russian sanctions being eased by the Trump administration has increased. On the other hand, it seems that OPEC+ is still ready to defend Brent from falling below the USD 70 -74 range.

There is not much to report from the fuel oil space. HSFO remains supported, though the cracks seem to have stabilised. We see a tendency for VLSFO to become more expensive, but the movements are much more moderate than HSFO.

We see an upside risk for distillate cracks over the coming months. It seems that more and more refineries are adhering to sanctions. Lately, Bloomberg reported that a Turkish refinery had decided to comply with US sanctions. There are also many reports of Ukrainian attacks on Russian refineries. Over time, it may dent Russia's ability to export products to the world market. Easing of US sanctions on Russia may work in the other direction.

Below, we discuss three factors that have weighed on oil prices and one supportive factor.