Bearish fundamentals in the oil market but growing geopolitical premium

The editorial deadline for this edition of the Weekly Market Report was before we knew the outcome of the telephone call between Trump and Putin today.

Since our last issue, the oil market has received plenty of news, yet traders appear to have become resigned to the current situation. Prices still hover around the USD 70 level and lack clear direction, though it seems that a geopolitical premium is once again creeping into the oil price after Israel attacked Gaza overnight.

We have argued that the risk remains to the upside for oil prices in Q2 and Q3 due to the stepped-up US sanctions on Iran, notably after the US attacked the Houthies in Yeman and Trump said he would hold Iran responsible if the Houthies again attacked vessels in the Red Sea.

While we still hold the view that there is an upside for prices in Q2 and Q3, we stress that the risk of a sudden drop in oil prices into the mid-USD 60s is increasing as trade war risks escalate almost daily. A trade war negatively affects global growth, trade, and oil demand.

A key theme for next week's oil market is the possibility of a truce between Russia and Ukraine. In that respect, the telephone call between Trump and Putin today after our editorial deadline will be key. Equally important is whether the US will ease sanctions on Russian energy as part of a ceasefire agreement.

The market will also monitor developments in the rapidly evolving trade disputes between the US, the EU, China, Canada, and Mexico.

Below, we discuss three key themes for the oil market.

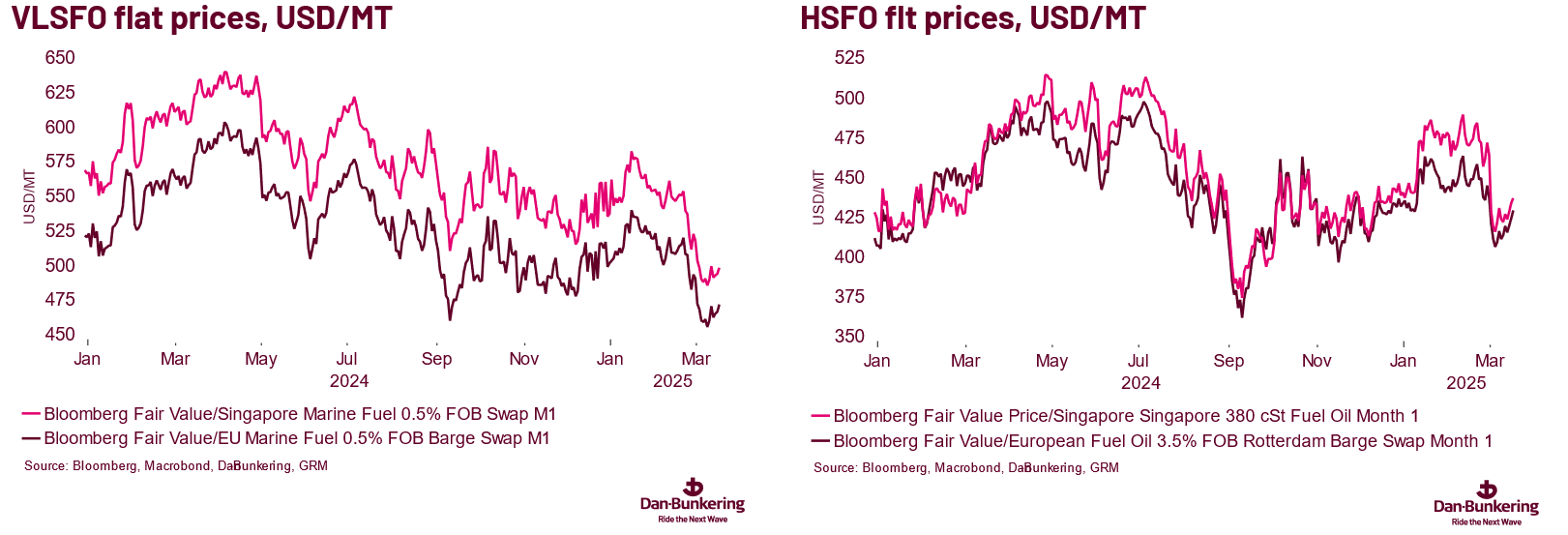

- The divergence in the fuel oil market between HSFO and VLSFO

- A ceasefire between Russia and Ukraine

- Tariffs and impact on global growth

- The recent oil market reports from the IEA and EIA