New US sanctions imply two-sided risks to oil prices

This time, we take a look at the latest developments in oil markets following Trump's new sanctions on Russia.

This time, we take a look at the latest developments in oil markets following Trump's new sanctions on Russia.

ARA

Few suppliers having loading issues on MGO, and avails are tight on the prompt.

Fujairah

Activity slowed in September, with HSFO rising to 36% of sales as demand softened and scrubber economics improved slightly. VLSFO premiums eased this week on barge reloads, but prompt supply remains tight, requiring around 5 working days’ notice. Reports of an unplanned outage at Kuwait’s Al Zour refinery could soon tighten VLSFO availability again, especially with ongoing UAE feedstock restrictions (UAE's ban on imports of South Sudan's Dar Crude - main feedstock for Vitol's refinery). Overall, expect HSFO demand to stay firm and VLSFO premiums to rebound if refinery constraints persist into next week.

New York

Demand maintains steady for heavy fuel and LSMGO from liner segment. Demand muted in NYH on spot.

Port Louis

Another quiet week in PL as the downturn continues.

Durban

Another quiet week in Durban, whilst PE demand appears to tick up.

Walvis Bay

Better weather in the region, but still waiting for the vessels to come for bunkers.

Houston did not report today.

For port availability and demand, download the full report here.

Sometimes, a week —or rather, one man —can make a significant difference. This time, we are, of course, talking about the sanctions on the Russian oil sector that Trump announced late last Wednesday. Importantly, this was not just random threats from the Oval Office but official sanctions from the Department of the Treasury’s Office of Foreign Assets Control (OFAC).

The US sanctions are the first significant measures against Russia under Trump, if we disregard the extra 25% tariffs on India for buying Russian oil. The White House has now sanctioned the two major state-owned oil companies, Lukoil and Rosneft. The goal is to target buyers of Russian crude – particularly ports and refineries in China and India – which could be exposed to “secondary” sanctions. This is effectively the first time Russia’s crude oil exports have been directly targeted. Recall that the G7 price cap’s primary aim was to force Russia to sell below global market prices.

We assess that these new sanctions are likely to have a real impact. It has become considerably more difficult for Russia to sell its oil. This comes as India appears to have agreed to cut its purchases, and Trump has also said he will put pressure on Xi to reduce China’s imports of Russian oil. Yesterday, Reuters, citing several sources, reported that China’s two largest state-owned refiners have suspended purchases of Russian crude following the US sanctions.

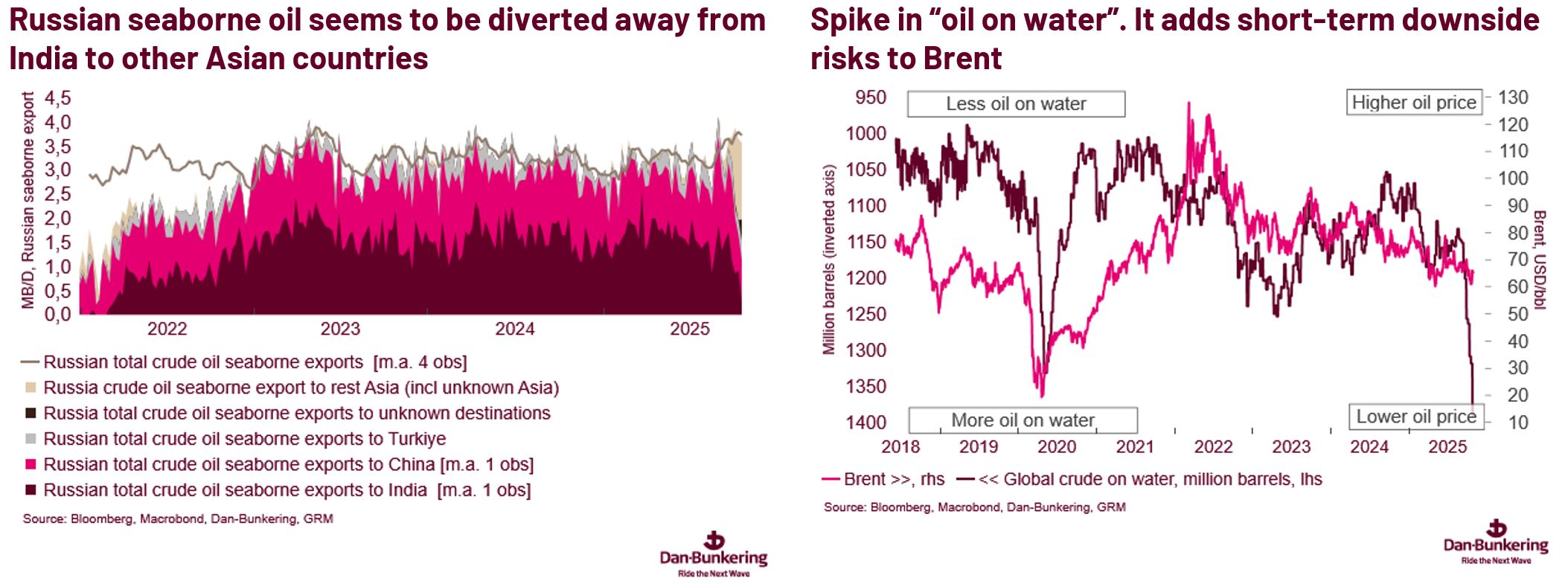

Following the news, the sentiment in the oil market has turned somewhat. Fears of a significant inventory build-up in the coming months have eased, as Russia is now expected to face greater difficulty exporting the same volumes as before. The sharp rise in “oil on water” may also reflect Russia's issues, even before the sanctions, in bringing its oil to market.

However, some of this uncertainty is already priced in, and focus is now shifting to news or data that can confirm or refute whether Russian exports are actually being affected.

Furthermore, Russia remains a master at evading sanctions through its shadow fleet. Recently, a growing share of Russian oil has been exported to “other Asian countries” beyond China and India. One may wonder where that oil ultimately ends up. The chart below shows Russia’s seaborne oil exports.

For now, geopolitics dominate, and sentiment in the oil market has turned. If Russia’s exports can be meaningfully restricted, it could absorb part of the expected oil surplus in the coming quarters. The downside risk to oil prices is now markedly smaller.

However, we have kept our forecast unchanged for now. Hence, we may see prices decline as inventories are still expected to rise over the coming months. But where we would have been buying in the low 60ties, we now see value from a risk management perspective in the mid 60ties.

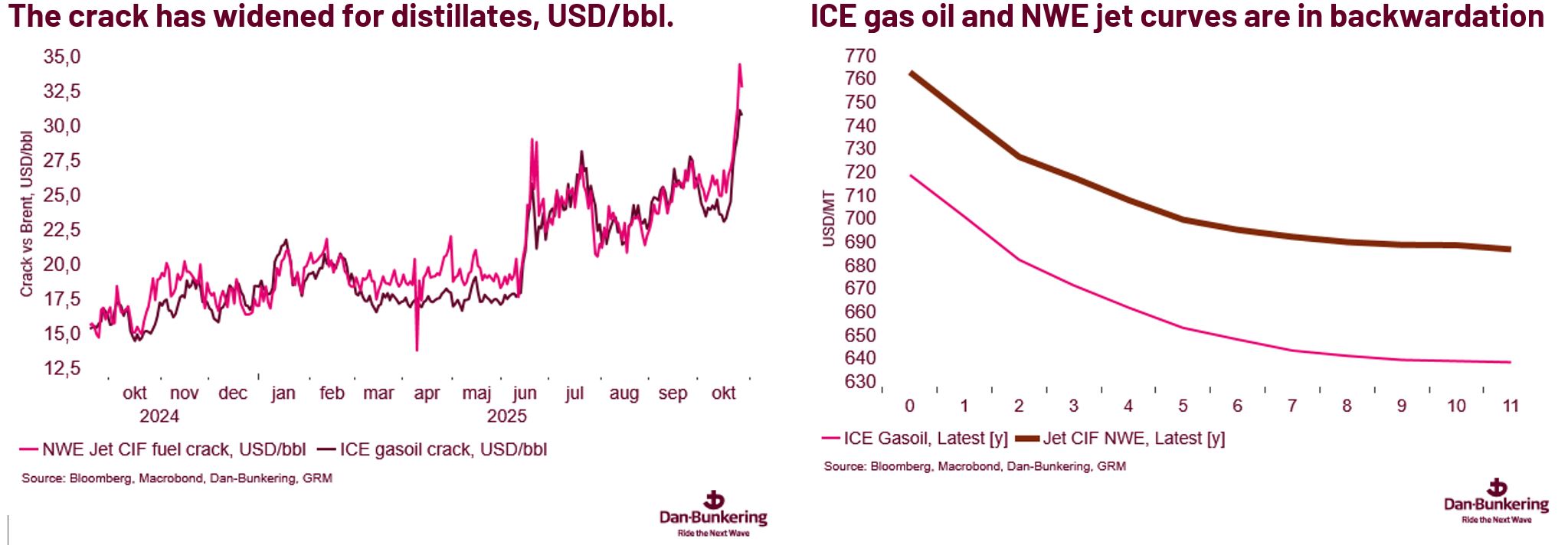

The US sanctions are also drawing attention to the gasoil, diesel, jet, and MGO markets. It will become more challenging for Russia to export diesel, and the production of diesel and gasoil in India and China, based on Russian crude, could be affected. Additionally, the EU’s sanctions on products refined from Russian oil will take effect on January 21.

We expect gasoil and diesel cracks (the price differential between a barrel of crude oil and a barrel of refined product) to rise further in the coming weeks. For buyers of diesel, gasoil, Marine Gas Oil, and jet fuel, we therefore keep our advice to have a high hedge ratio even after the price spike over the last couple of days. Note that the curve remains in backwardation; that is, forward prices are below spot prices.

The big story in the fuel oil market has been the strong HSFO (3.5%) market and the weak VLSFO (0.5%) market, which has pushed the so-called scrubber-spread HI5-spread (difference between VLSFO and HSFO) to a record low.

The market is abundant with VLSFO, and demand is lacklustre. On the other hand, the demand for HSFO seems strong across the board.

If the sanctions prove effective, they would tend to remove Russian sour and heavy crude oil from the global market. This oil will tend to be replaced with lighter slates like WTI. If we add the risk of tougher sanctions against Venezuela in light of the tougher White House rhetoric towards President Maduro, the risk is growing that we will see less heavy sour crude oil in the market. It means less residual oil and, ultimately, less HSFO in the market.

In other words, even after HSFO's strong performance relative to Brent, the risk is still tilted to the upside.