First signs of stabilsation in the oil market…but uncertainty remains high

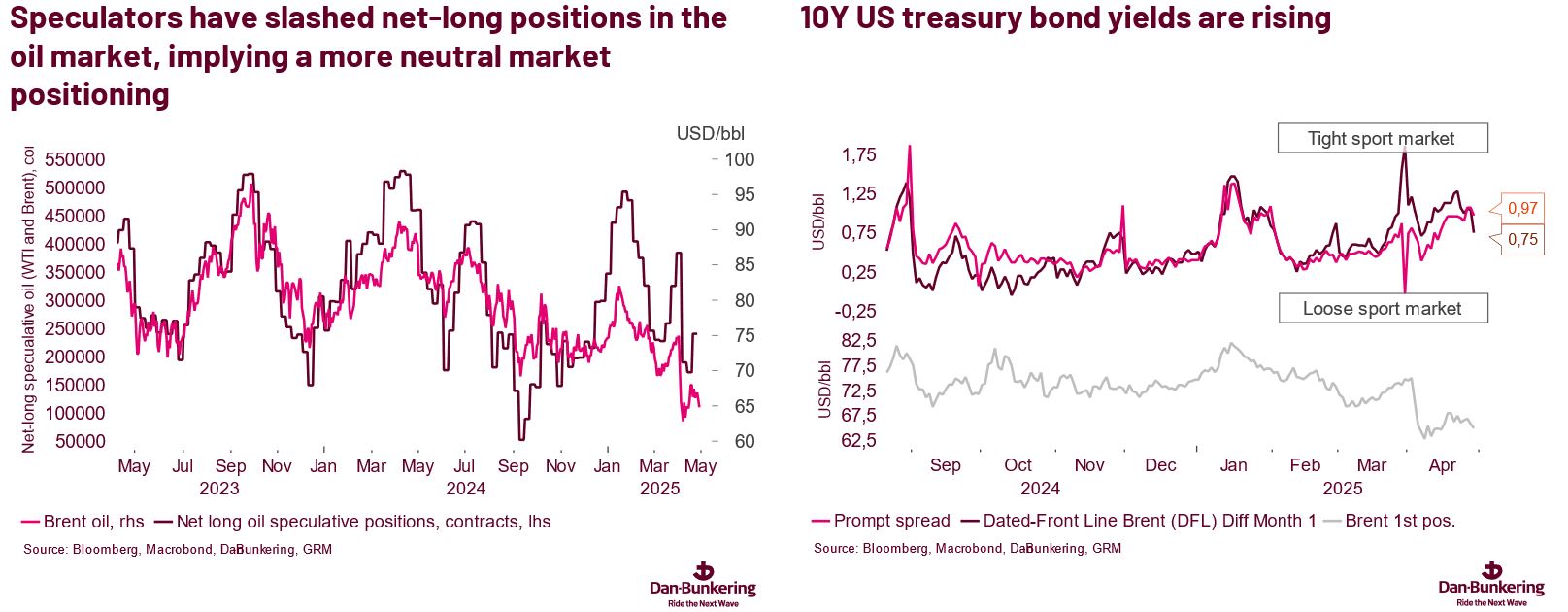

Oil prices have been in for a real Trump roller-coaster here in April. Brent traded briefly above USD 75 when Trump entered the Rose Garden outside the White House on “Liberation Day” April 2nd. However, as the infamous poster with the high tariffs was presented and China started to retaliate, the bullish sentiment turned around, and we saw one of the biggest two-day drops in prices for several years.

However, as we argue below, we are starting to see signs of stabilisation in the oil market and other markets. Brent is now trading just above USD 65.

The apparent stabilisation of the oil market also suggests that buyers should consider utilising today’s price levels and curves, which for many products are still in backwardation (lower forward prices), to increase their hedging.

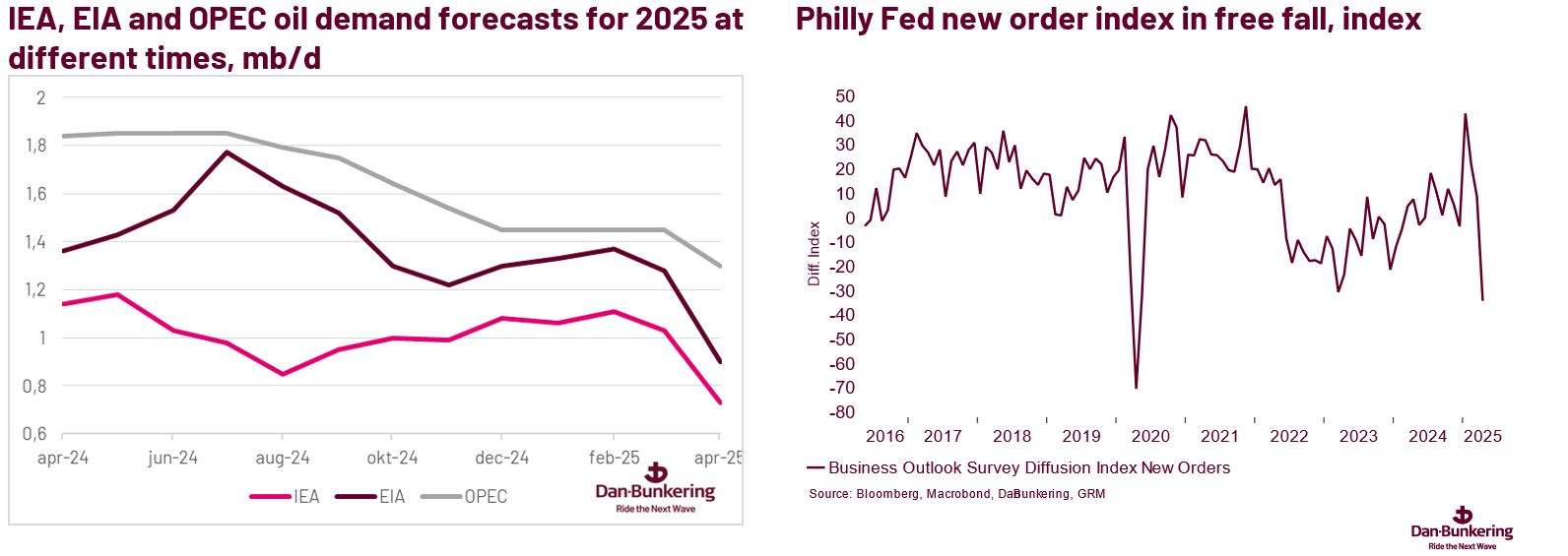

However, the trees do grow into the sky for oil prices. High volatility is still expected to prevail in the oil market over the coming months.

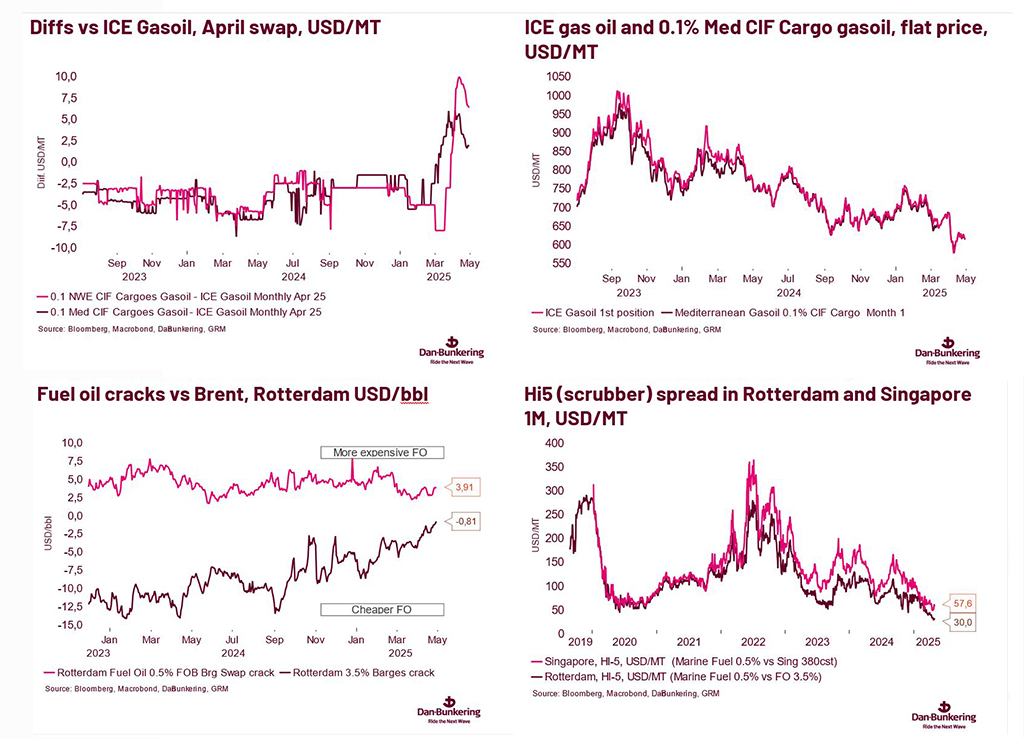

In today’s issue, we discuss some of the stabilising factors and some of the factors that still suggest lower oil prices. We also provide a quick overview of the latest marine fuel oil market developments, where the Mediterranean Sulphur Emission Control Area, SECA, is introduced May 1.

Overall, we reiterate that we see strong support for Brent in the USD 60–64 range. However, with the stabilisation of financial markets, we may slowly return to the USD 70 level over the coing three to four months.

Hence, in today's issue, we take a closer look at,

- Factors that have supported a more stable oil market

- What could trigger a new move lower

- Marine fuel update with focus on the Med and the Sulphur Emission Control Area