The war is over, and the remaining risk premium is being priced out

This text had an editorial deadline of Tuesday 7.00 AM CET.

Overnight, Trump announced that Iran and Israel have agreed to a ceasefire, which came into effect at 6:00 AM CET. This brings the war to an official end after 12 intense and bloody days. According to Trump, there is a 12-hour window to wrap up hostilities and ongoing operations, meaning reports of fighting this morning does not necessarily indicate that the truce has been broken.

After 24 hours, the war should be entirely over. In typical fashion, Trump posted on his social media platform that the war should be known as “THE 12 DAY WAR” – in all caps, of course.

Iran has stated that the ceasefire is conditional on Israel halting its attacks. Israel has not issued an official statement, but according to the US, the deal was agreed directly with Netanyahu.

Already yesterday afternoon, the market saw signs that Iran had no plans to escalate following the US strikes over the weekend. Missiles were indeed fired at the American base in Qatar, but Iran had already informed both the Americans and the Qataris in advance. All missiles were intercepted.

The approach was very similar to Iran’s symbolic attacks on Israel last year and the retaliatory strike after the US killed General Soleimani in 2020 – all three being largely symbolic missile attacks.

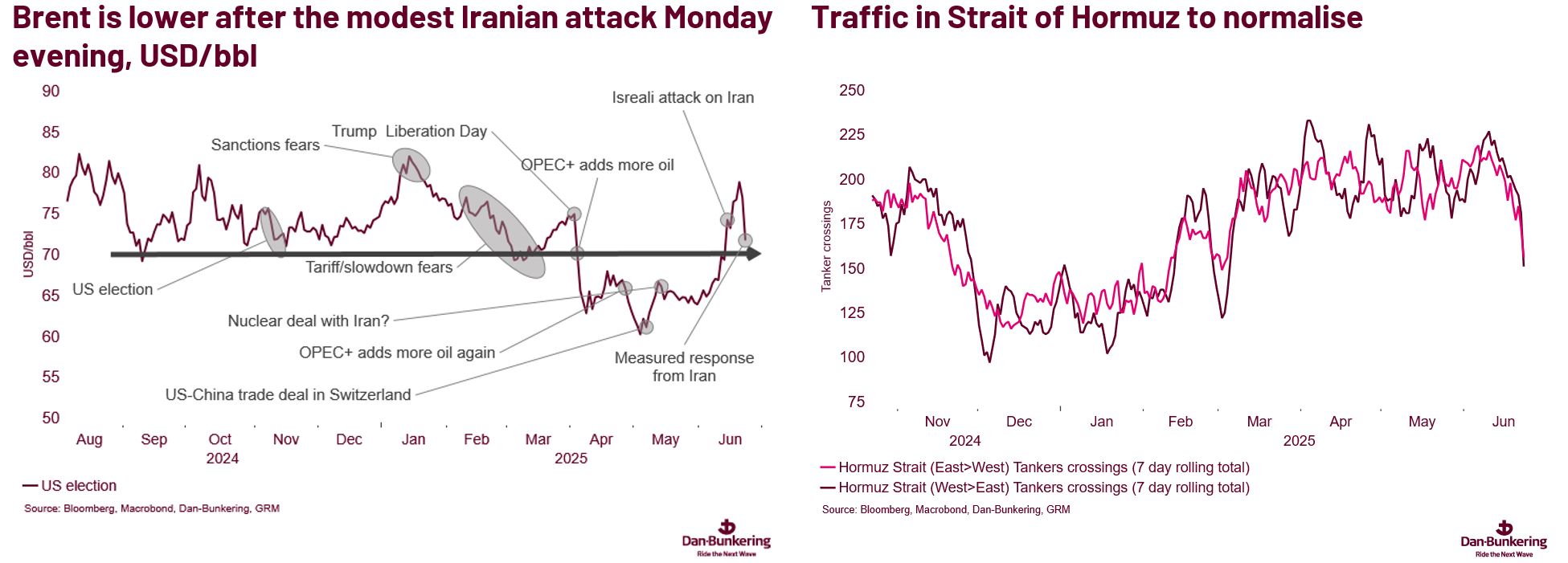

The symbolic nature of the latest strike triggered the most significant single-day drop in Brent since 2022. Brent opened above USD 80 in Asia after the US strikes but closed almost USD 10 lower, just over USD 70. This morning, Brent is trading slightly below USD 70. Talk of a Hormuz Strait closure and broader war risk has completely faded for now.

The market has already priced out much of the war-related risk premium built in over the past 12 days. We believe a small premium remains.

A fair value for Brent likely sits in the USD 65–70 range. A soft dollar and strong risk appetite are supporting oil prices this morning; however, the overall bias remains to the downside today.

We also expect cracks in diesel, gasoil and HSFO to decline.